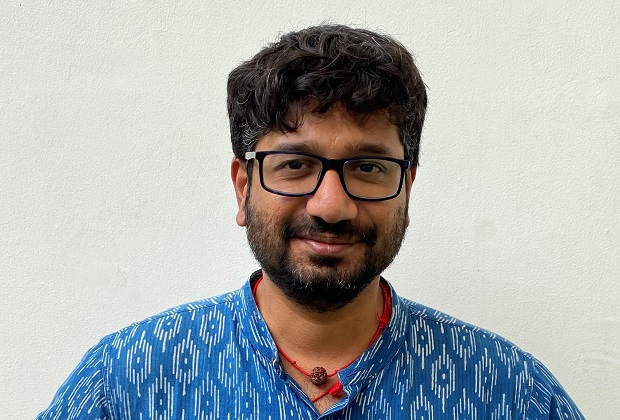

The startup was floated in 2021. It recently raised over Rs 11.5 crore funds in a Pre-Series A round. The startup plans to expand its business and network across India and aims to replace 1 percent of India’s fossil fuel with biofuels in the next five years. In an interview with Iamrenew, Kishan Karunakaran, the Chief Executive Officer (CEO) of Buyofuel, shared his experiences with this unique online market platform. Excerpts from the interview:

The other co-founders of Buyofuel and I started conceptualizing the idea towards the end of 2018. The company began operations in 2021 with the new concept of trading biofuel online. I had an earlier industry experience of around 15 years. I worked towards establishing Tamil Nadu’s first biodiesel plant in 2008.

In 2018, the Indian government banned the imports of biofuel. In the same year, it also developed the National Biofuel Policy. With clear directions from the government, the anticipated market potential, and our experience in the sector, we jumped onto the bandwagon. But instead of choosing the conventional path of producing biofuels, we tried to bridge the gap among the waste suppliers, biofuel manufacturers, and end users. I and other co-founders, Venkateswaran Selvan, Sumanth Selvarasu and Prasad P Nair, all from different expertise, came together and made this possible.

We do not manufacture biofuels on our own. We source wastes from waste generators and aggregators and sell them to biofuel manufacturers. We also take the biofuels from the manufacturers and sell them to the fuel consumers. We function as a curated marketplace from both sides. We deal with almost every type of biofuel and all forms of waste to fuel. Whether agri-based residual wastes, biomass briquettes, vegetable oil refinery-based biodiesel, waste plastic-based plastic pyloric fuel, or sewerage-based bio-CNG, we deal with all these. Mostly our main volume is from biomass briquettes and various agri residual biomass that replace coal.

Funding always remains a challenge for startups. However, many things went in our favour too, which helped us thrive. It was because we had a good experience in the sector. Other co-founders had around 12-15 years of experience in supply and IT. We were incubated in a startup challenge that was based on UN SDG goals. We were also among the top 10 startups in Tamil Nadu under the startup challenge. It helped us to increase our client base and also helped bolster our presence before the Venture Capital Funders.

The government had also mandated to use a certain portion of biofuels in coal industries. These indicate the enormous potential of the biofuel market in India. In 2021 we were the first movers into this to step towards creating an organized online market for biofuel trade.

We have witnessed good growth in the last two years. In 2021-22 we grew from Rs 58 lakh to Rs 60 lakh of revenue. In 2022-23, we closed it to Rs 50 crore, around 50 times growth, which was an appreciable jump. We currently have significant industries ranging from cement, power producers, tyre makers, and steel to many others as our regular clients. Aditya Birla, Adani, JSW, TVS, and Thermax are some of our regular and fixed clients.

We are yet to become EBITDA positive, but we are witnessing good gross profits. From the volume perspective, we consistently trade around 10,000 tonnes of waste and biofuel transactions per month. Most of our orders are regular and repeat orders.

Sugar mills often have their processing unit to make bio-ethanol. Under the National Ethanol Blending Programme, the Oil Marketing Companies (OMCs) ensure the offtake of biofuel from them. Most biofuels have a market from the demand side but need an organized market from the supply side. However, in the case of bioethanol, there is an existing demand and supply side market. So we only had a little market share in this category.

However, we will also step into this sector with the government’s thrust on second-generation (2G) crops/feedstock for bioethanol production. Many bioethanol producers based on 2G feedstocks have just ventured into the market and would need at least six months to establish things. With this, we would increase the trading of bioethanol too.

From the volume point of view and value point of view, it is the biomass briquettes. This year, we also see good growth in liquid biofuels –biodiesel manufacturing and industrial biofuels. However, around 60 percent of our market trade comes from biomass briquettes. We are increasing our market in biodiesel and industrial biofuels too. Sixty percent of our value comes from briquettes and wastes going into manufacturing.

Not from any large Business-To-Customer or Business-To-Business e-commerce sites. Dealing with the industry, it requires extensive subject knowledge and expertise from the waste and production side. We are the leading players. We do have direct competition from another biofuel market. But they deal with solid biofuel and biomass. They only handle some types of biofuels.

Many of our waste producers are farmers living in rural areas. Many of them used the help of waste aggregators earlier, and a conventional supply side ensured the feedstock delivery to make biofuels. However, we tried to disrupt there and created a new model to take the waste materials/feedstock directly from the farmers or other players. It ensured evading the intermediaries’ route. With this, on average, the producers can now earn around 10 percent more; in many cases, their margins also increased up to 25 percent. The whole ecosystem that we created also worked towards word-of-mouth publicity for our marketplace.

Our network and business partners are now mainly confined to Tamil Nadu and Kerala. Now we want to expand the network across India. With the latest fundraiser, we are entering states like Gujarat, Punjab, and Haryana. We plan to replace around 1 percent of India’s total fossil fuel-derived energy with biofuel by the next five years. Although the percentage sounds small, it accounts for supplies of 13 million tonnes of biofuel.

1. The mandate for blending Compressed Biogas (CBG) with natural gas has come into effect…

Andhra Pradesh is striving towards greening its energy sector with quite some speed. In a…

With an objective to bolster India’s green energy goals, a Tripartite Agreement has been signed…

The Union MNRE Minister Pralhad Joshi launched the Green Hydrogen Certification Scheme of India (GHCI)…

India’s energy conglomerate Bharat Petroleum Corporation Limited (BPCL) has commissioned a 5MW green hydrogen plant…

In a historical development, the European Space Agency (ESA) has successfully launched its pioneering ‘Biomass’…