The GST Council of India has come out with a clarification over the rates for solar power projects. Solar Panels have been classifies under the 5% tax slab however the industry has contested that other equipment such as metals, electrical materials and other materials are under higher tax slabs that increases the cost of power.

As a clarification the council in a statement said, “ 70 per cent of the gross value of project shall be deemed as the value of supply of said goods attracting 5 per cent rate.” The remaining portion (30%) of the aggregate value of such EPC contract shall be deemed as the value of supply of taxable service attracting standard GST rate.

The text of the clarification states:

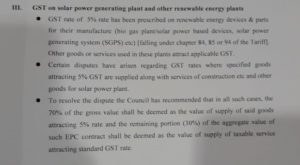

GST on solar power generating plant and other renewable energy plants

GST rate of 5% rate has been prescribed on renewable energy devices & parts for their manufacture (bio gas plant/solar power based devices, solar power generating system (SGPS) etc) [falling under chapter 84, 85 or 94 of the Tariff]. Other goods or services used in these plants attract applicable GST.

Certain disputes have arisen regarding GST rates where specified goods attracting 5% GST are supplied along with services of construction etc and other goods for solar power plant.

To resolve the dispute the Council has recommended that in all such cases, the 70% of the gross value shall be deemed as the value of supply of said goods attracting 5% rate and the remaining portion (30%) of the aggregate value of such EPC contract shall be deemed as the value of supply of taxable service attracting standard GST rate.

Country’s solar industry in July had sent an SOS to the policymakers including the Industry and finance officials seeking urgent clarification on the rate of goods and services tax (GST) on solar projects after controversial Authority for Advance Rulings (AAR) held these would face 18% and not 5%.

The problem had its genesis in the fact that concessional GST rate of 5% applies to solar power generating system, but solar power generating systems (SPGS) are is not defined in the law.

The absence of a definition had led to ambiguity and different interpretations with regard to meaning and taxability of SPGS. The Solar Power Developers Association (SPDA) in a representation to the finance secretary Hasmukh Adhia has petitioned that the ambiguity in interpretation and diverse advance rulings on the issue should be examined by the GST Council.

This, the industry experts had feared, could not only derail its whole arithmetic on tariffs and render projects unviable but also dent Prime Minister Narendra Modi’s plan for 100 gigawatts of solar power capacity by 2022.

Reliance Industries Ltd (RIL) Chairman Mukesh Ambani has announced a massive ₹75,000 crore investment in…

Green-energy heavy-duty truck maker Blue Energy Motors has reached a remarkable milestone by surpassing 50…

India is on track to exceed its Nationally Determined Contribution (NDC) target of reducing the…

Raj Process Equipments and Systems Pvt Ltd, a Pune-based technology innovator and engineering conglomerate, is…

Europe’s renewable energy sector faces a potential slowdown, burdened by grid saturation, permitting delays, and…

Hexa Climate has announced the launch of a pioneering afforestation project in Purulia, West Bengal.…