The Wait Could be longer

Kerala, a state not exactly known for its manufacturing prowess, has a stated goal to ‘manufacture’ 3000 electric buses under the state’s electric vehicles policy. Until then, the state is set to acquire 1500 to connect its urbanised population with a non polluting option.

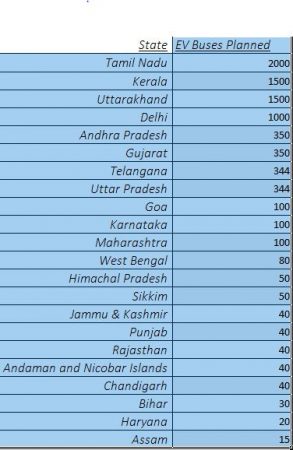

But that was just one exception among the many states in India that have been making announcements for major electric bus purchases. At this stage, it seems clear that most of these purchases will be riding on the incentives available under the Faster Adoption and Manufacturing Scheme 2 (FAME-II), which has a clear focus on commercial transport.

While most of these orders are meant for the state, and in Delhi’s case, the national capital, the sheer numbers indicate that an electric bus may be a common sight across top cities in India by the end of 2020.

What’s more, with the majority of the plans touted as pilots or a phase 1 buy, if things go well, India’s pubic transport sector could be set for a major overhaul. Of course, with the challenge of air pollution across most of these cities, and volatile fuel costs, electric buses might yet prove to be a smart call.

Of course, while the list above is based on a collation of announcements made, the absentees in the list are also notable. The ecologically fragile Northeast of the country for instance is completely absent, except for the larger Assam state. That might be a function of both the size of the state economies, the local roads and charging infrastructure, and the need for a subsidy that goes beyond what FAME-II offers.

That might explain why even other larger notables like Odisha, Chhattisgarh and Jharkhand, states that are financially strapped, don’t figure in the list, even for a small pilot.

Hopefully, that will change. Coincidentally, all three states happen to have large coal mining belts too and lag on solar installations. Odisha of course has made an announcement to have electric buses for its three key cities, without specifying numbers or a timeline.

For electric bus manufacturers eyeing the market, the next few months could be crucial to make the right impact in the market, in terms of the experience buying states have with the buses, and how supporting infrastructure is created.

Charging infrastructure for these buses will need to move in lockstep with every delivery, to prevent opinion shifting away from adding more, or going slow. With the speed at which government backed procurement moves, any major misstep risks pushing back the EV dateline by many months, if not years. Keep in mind that 100% of the orders announced so far have been by government backed or owned entities.

A key test of real acceptability will be the entry of private transport operators. Their entry will mark the real opening up of the market in India, as privately owned transport remains a much larger component of public transport networks in India.

At this stage, the few operators we have spoken to scoff at the idea of EV’s, calling them ‘overpriced’ white elephants. State owned buses that simply stay on the roads and get noticed, could change that perception, though it will be some time before electric buses become a common sight on long distance routes of more than 200 kms.

India’s ethanol initiative has helped India save Rs. 1,26,210 crore in foreign exchange by reducing…

Noida-based green energy leader NexGen Energia Ltd has secured a $1 billion equity investment commitment…

As Odisha takes firm steps toward a just transition from fossil fuels to renewable energy,…

Bio-Integrated cladding for greener cities, an innovative solution by a 29-year-old Indian architect, has won…

In a novel move, Farmwatt Innovation has launched a long-term training and capacity-building initiative focused…

State owned Bharat Petroleum Corporation Ltd (BPCL) has joined hands with GPS Renewables Pvt Ltd…