NIO Capital report Says Only 1% of China Electric Car Start ups will Survive

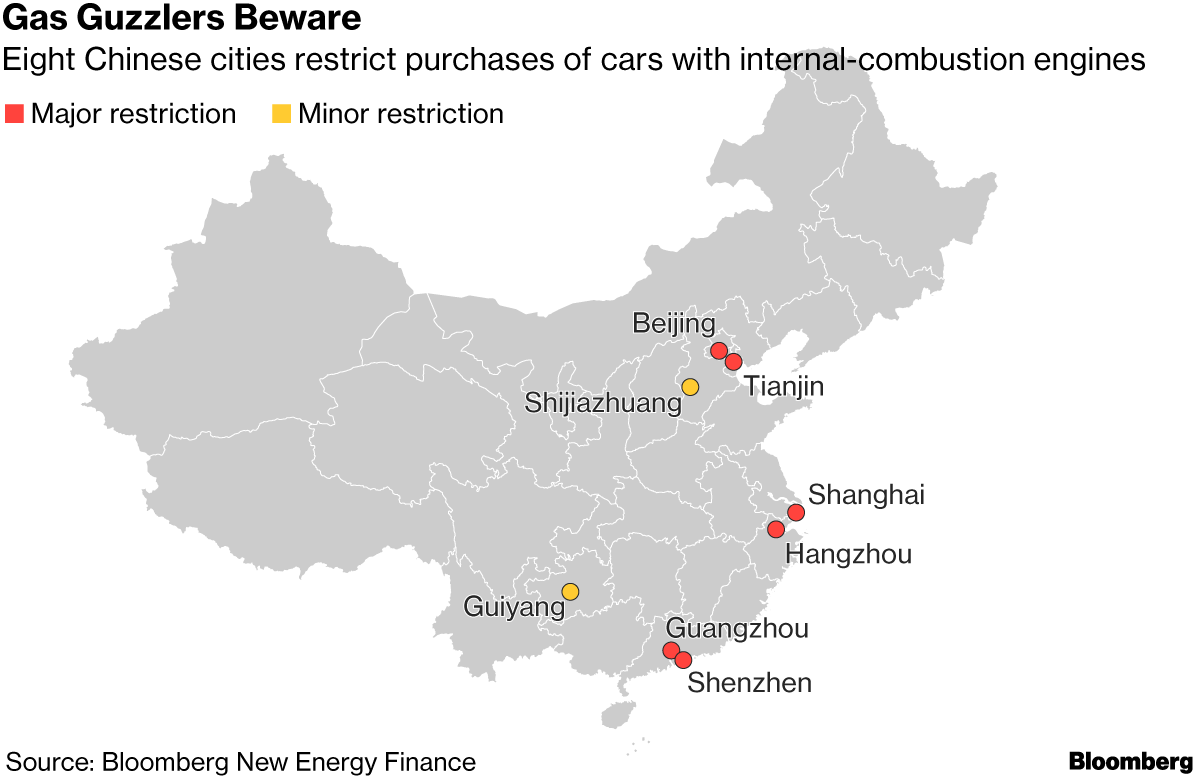

The Chinese investment firm, NIO Capital, which is partly backed by Chinese electric-vehicle company NIO in its report has painted a very grim picture for the EV startup landscape in China. Soon after the EV push in the major cities of China, the global EV sales have been fuelled by the Chinese after 2011. China now comprises 37% of all passenger EV sales in the world and around 99% of e-buses. This trend is likely to continue, with the analysts expecting 42% of the next million EVs until the five million milestones, to be sold in China.

The venture capital fund is nonetheless very cautious on buying into EV startups and favours investing in joint projects between auto start-ups and traditional car makers because they combine innovation with real manufacturing capabilities. As most EV startups in China are yet to manufacture on a large scale or be able to deliver cars in bulk to consumers.

The Managing Partner Ian Zhu says, “It’s a very complicated system that needs abundant investments and a large group of people to be able to build a car from scratch,” and added, “Therefore, the survival rate of all these EV startups will be very low.”

China’s quest to lead the world in cars powered by electricity has enticed investors to pour billions of dollars into startups and production despite the lack of production facilities required for mass production. Emboldened by Tesla Inc.’s still small presence in what is the biggest market for EVs, companies like Xpeng Motors Technology Ltd. and have also been racing to gain a foothold.

Rising Competition

And competition in China — where more than half of the world’s EVs are sold — is set to intensify, with Beijing’s shift to allow foreign car brands to fully own their local units. Trade tensions between the world’s two biggest economies, the US and China, are also pushing big international car makers such as BMW AG and Tesla to accelerate their plans to locally produce EV models in China.

The trade war will also create more hurdles to investment in technology which is required to pick up the pace of rolling out more electric cars for the Chinese burgeoning market, slowing the car industry’s pivot toward self-driving vehicles.