The electric mobility revolution in India will arrive on two wheels. That seems to be the basic message of a research report turned out by JMK Research and Analytics, which looks at the exiting, potential, and industry view of the electric two wheeler market in the country.

Two wheelers, which constitute 70 percent of the market in India, making it the worlds largest two wheeler market, are an obvious case for expecting a change first. Government subsidies under the FAME2 ( Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) programme will also help , thanks to the lower subsidy amounts needed here, unlike personal cars. The government has already expressed a preference to fund pubic transport with subsidies, and not personal 4 wheelers. Importantly domestic component requirements like 50 percent for vehicles will also be easier to meet on electric two wheelers, where Indian firms have been globally competitive for a while now.

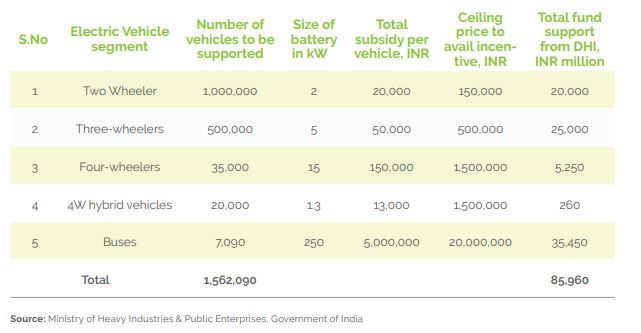

Planned Subsidies For the Electric Mobility Transition in FAME 2

According to JMK Research, the most significant reason for expansion would be drop in prices of batteries, to a level of $100 KwH by 2025. That is what will spur market expsnsion to almost 3.4 million sales by 2025, an 87 percent CAGR over 2020 sales of 1,52,000 according to them. 2019-20 sales, hit as they have been by the Covid lockdowns, have still managed to grow 20 percent over 2018-19.

n the last few years, India has shown considerable progress in the electric two-wheeler (E2W) space with serious players entering the market such as TVS, Bajaj, and Hero. From FY2016 till FY2020, the E2W market in India has grown by a CAGR of 62%. Also, more than US$600 million of investments have been raised by various E2W startup companies in the last two years.

A key sign that the push will come from both market players and the government is the entry of multiple startups in the two wheeler space, which have ensured a wider basket of choices and price points for buyers. Of course, every player has had to go back to the drawing table to meet government mandated specifications to qualify for subsidies, from minimum speeds to range to battery types.

Besides these, waiver of registration fees, and lower GST rates have also supported the push.

Approved Models That Qualify For Subsidy

While South Indian states have led the move to electric so far, as prices drop, North India is also bound to join in soon.

For details, refer to detailed report by JMK here.

The Uttar Pradesh capital city of Lucknow will soon see the construction of a waste-to-energy…

In a major development, India Glycols Limited has increased its grain-based distillery capacity by an…

As Gorakhpur continues to take strides in biofuel generation in the country, Uttar Pradesh Chief…

Just as the quest for green energy generation is gaining momentum in the country, Refex…

The first unit of the Compressed Biogas Plant built by Reliance at the Peddapuram Industrial…

As Karnataka gains momentum in the direction of ‘waste to energy,’ the Mysuru City Corporation…