BNEF’s reputation as progressive on EV adoption projections is in question after its latest Electric Vehicle Outlook report trims its previous projections of sales across the coming decade down 10%, and assumes annual growth rates will quickly drop to 23–24% from the current rate of 56%. The main bottleneck BNEF sees is battery manufacturing capacity. By the firm’s in-house estimates, battery manufacturing capacity grows only enough to supply 10 million EVs annually by 2025. Leading battery forecasters, Benchmark Minerals, see future battery capacity much higher than this.

BNEF treads a tricky line between analyzing and advocating for “New Energy” technologies whilst not upsetting the incumbent legacy players.

Unsurprisingly then, BNEF’s track record in “EV Outlook” reports has consistently underestimated the true growth rates. BNEF’s 2017 EV Outlook predicted 1.02 million passenger EV sales for the year, a growth of 46.7% from 2016’s 695,000 sales. Eventual 2017 sales — by BNEF’s own subsequent reckoning — were 1.091 million, a growth of 57%.

Undeterred, in April 2018, BNEF’s Outlook projected EV sales would grow from 2017’s 1.091 million to 1.59 million in 2018, an increase of 46%. BNEF actually switched its methodology after this (previously counting just passenger vehicles, now counting all LDVs — light duty vehicles) so the analysts didn’t hand in their homework for their 2018 projections.

BNEF’s 2019 EV Outlook

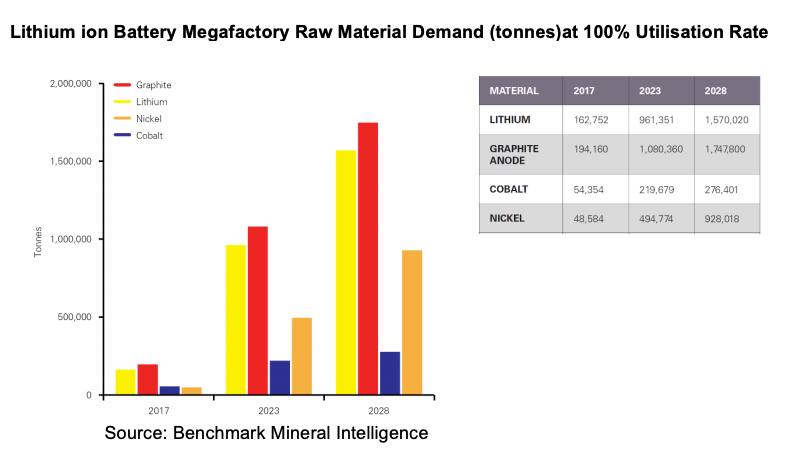

This year’s BNEF EV Outlook projects sales in 2025 will be 10 million (down from 2018’s projection of 11 million). Projected 2030 figures are down to 28 million from 2018’s 30 million. The main reason for these lackluster numbers is BNEF’s modeling of battery manufacturing capacity out to 2025 and 2030. It sees the 10 million limit in 2025 not due to any lack of demand, but constrained by its projected 1 TWh global battery cell manufacturing limit in 2025.

The report assumes two thirds of this 1 TWh annual capacity in 2025 will go to passenger EVs, which will each require an average of 66 kWh (gross) battery capacity. The result is only enough supply for 10 million vehicles in 2025.

There’s no scope for future growth of battery manufacturing capacity in BNEF’s modeling — the forecast for capacity in 2025 (6 years from now) appears to be locked down. But it’s worth noting that BNEF does not claim leading expertise on battery manufacturing pipelines.

For EVs, the green transition of 2.5% to 50% has already happened in Norway, taking around 7 years. Iceland is on track, with the move from 2.5% to >25% (expected this year) taking 5 years. Its 2.5% to 10% move took 3 years. Sweden is passing 10% this year, 4 years after passing 2.5%. China passed 2.5% in 2017–2018 and looks set to pass 10% in late 2019 or 2020 (around 2.5 years).

Finally, BNEF has some outlier predictions are— having reached 9.5 million annual sales in 2030 (a little under 50% market share) — China’s EV sales will grow by just 4.25% annually between 2030 and 2040 (reaching 14.6 million sales, around 70% market share in 2040).

In a significant move toward advancing green energy and industrial growth in the state, Himachal…

Golabl chemical conglomerate BASF has announced that its now offering the world’s first biomass-balanced polyethersulfone…

In a crucial stint to bolster the biogas sector and sustainable dairying in the country,…

TotalEnergies SE has received approval to proceed with its Middlebrook solar and battery project in…

Andhra Pradesh Chief Minister Chandrababu Naidu has inaugurated the Rs 1,000-crore green hydrogen plant of…

The BITS Pilani has developed an innovative solution for managing landfill leachate, domestic septage, and…