World’s Biggest Utilities & Sovereign Funds’ Continue Shift to RE

Big Names towards RE

Big Names towards RE

Based on the current market value, the majority of the world’s biggest utility companies are based in the US and Europe. We take a look at the top of each of the continent:

Duke Energy

Highest ranked among all the US utilities is Duke Energy, with a base of 7.7 million electric and 1.6 million gas customers. According to Investopedia the company in 2018 had an operating revenue of $23.9 billion, market capitalisation of $52 billion and $133 billion in capital assets.

Duke Energy has shifted its focus towards emerging business cases or technologies like electric vehicles (EVs), renewable energy, smart meters, workforce development and management, and demand response and energy efficiency.

In what is believed to be one of the largest utility investments in EV pilots in the US, Duke Energy has recently asked the North Carolina Utilities Commission to spend $76 million to provide consumers with incentives to install EV charging stations.

If approved, the pilot will lead to almost 2,500 new charging stations and an increase in the use of electric buses for schools and public transportation. North Carolina currently has 10,000 plug-in vehicles and 600 public charging stations.

Duke Energy has also connected more than 500MW of new solar capacity – enough to power about 100,000 homes at peak output in 2018. The utility is operating more than 35 solar facilities in North Carolina and has invested more than $1 billion in renewable energy in the state.

Duke Energy has also engaged in a number of partnerships, including with Carolinas Energy Workforce Consortium, S.C Technical College and solution providers to ensure its workforce is qualified to operate next-generation technologies the utility is adopting.

The utility has also appeared in reports on smart meters published by research firms as a leader in implementing the technology.

“North America has seen several new smart meter projects announcements from larger utilities. Announcements made include by Dominion Virginia, Duke Energy Florida, and Tampa Electric,” according to an AMI tracker issued by Navigant Research during the second quarter of 2018.

Engie

The number two is French utility Engie, with €65 billion in revenues and market capitalization of €31.52 billion, as of June 2018.

In an effort to create new revenue streams by tapping into emerging business cases, as well as contribute towards the energy transition, Engie signed a deal with Chilean public transport operator Transantiago to electrify the public transport system in Santiago.

The deal will enable some 100 electric buses to be powered by 100% renewable energy as well as the installation of 50 EV charging stations.

To expand its global presence, Engie has acquired Swiss smart home energy management solutions firm Tiko Energy. The acquisition is expected to help Engie to achieve its decentralization and digitization goals by offering services in the water heaters, heat pumps, solar panels, batteries and electrical outlets segments.

The two way flow of energy and data between the utility and the consumer seems to be opening up new possibilities for innovation within the industry. Hence, collaboration with third parties has evolved from being a threat for utility operations and revenue generation to being a source of new ideas and revenue streams.

Oil-rich sovereign funds exploring renewable energy

Sovereign wealth funds from oil-rich countries in the Middle East are also seen moving to diversify into renewable energy, pushed by regulators and pledges on climate change.

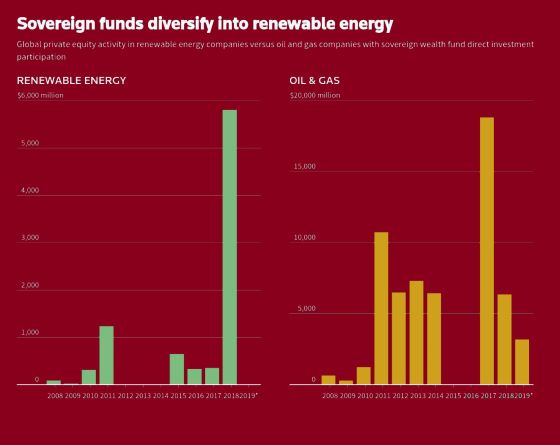

For long, total sovereign wealth fund investments within the oil and gas industry have dwarfed those within renewable energy in the past decade. But data on private equity investments with sovereign wealth fund participation suggests this balance might be shifting. In 2018, $6.36 billion went into hydrocarbons, compared to $5.81 billion in renewable energy, one of the narrowest margins in the past decade, according to PitchBook, a data and research firm.

Data on sovereign wealth fund investments via the stock and bond markets are harder to interpret as many of the funds do not disclose such information.

Norway’s 1 trillion-dollar sovereign wealth fund, the world’s biggest, said last month it would sell its stakes in 134 oil and gas explorers and producers, worth almost $8bn. But the fund also said it would still invest in energy firms that have refineries and other downstream activities, such as Royal Dutch Shell and ExxonMobil.

Earlier this month, Norway’s sovereign wealth fund decided to plug billions of dollars into wind and solar power projects. The decision follows Saudi Arabia’s oil fund selling off its last oil and gas assets. Now the sum the fund can invest in green projects has been doubled to $14bn.

Saudi Arabia’s Public Investment Fund sold its last investment linked to oil and gas last week, with the sale of its $69bn stake in Saudi Basic Industries Corp to the nation’s oil company, Aramco.

Other national funds built up from oil profits are also thought to be ramping up their investments in renewables. The moves show that countries that got rich on fossil fuels are diversifying their investments and seeking future profits in the clean energy needed to combat climate change.

In 2018, ADIA, QIA and PIF and Norway’s fund were among six that agreed to a framework called One Planet, pledging to add climate change considerations into their investment decisions, a sign that the funds are starting to change their approach.The data corroborates the scenario which shows the growth of investment to $5.8bn in renewable energy compared with just $0.4bn in 2017.

We believe that trends within the energy sector and utility industry highlight the need and positive response by energy providers to invest in new business cases and technologies for survival. Nowadays, merger and acquisition of startups have become a vital element for utilities wanting to improve their offerings to meet evolving customer demands.

Ironically, funds that have been oil funded moving away from oil could actually benefit oil producers perversely in the short term, especially those like Saudi Arabia where the cost of extraction is very low. Choking off funding to other extractors could actually support, or even lead to higher prices. However, in the medium to long term, it could help make the case for renewables better by improving their viability on a comparison with oil fired energy. Something we are seeing in massive oil guzzlers like India, where extremely high taxes on oil have ensured that consumers have limited upside to a drop in oil prices, but almost unlimited exposure to the pain of rising prices.