The African continent is set for growth, the population is expected to grow by 1.4 percent each year until 2030. GDP is expected to grow by 4 percent. This development is demanding huge investments in infrastructure including the energy markets to keep up with the growth, access to electricity being one of the main challenges African citizens consider to encompass and unlock their growth path. African governments have acknowledged that growth can only be supported through sustainable solutions, which means an obvious opportunity for wind energy.

Offering a cost-competitive solution, wind energy has the potential to drive not only the electrification level in Africa (currently only 43 percent of people living in Sub-Saharan Africa have access to electricity according to the World Energy Outlook 2018 from IEA) but to also support the economic growth and development of African markets.

With now over 5 GW of installed onshore wind energy, the majority of them installed during the recent three years, there has been good progress. Still, the share of wind energy in the energy mix of the African continent is around 1 percent (IEA WEO 2018), as thermal and hydro power still dominate. Despite this low share, several governments have committed to increasing the share of wind and renewable energy over the next years.

For wind energy resources, Africa is endowed with considerably the highest potential in the world, nearly 100 GW potential, according to IRENA REMAP 2030 report.

Kenya certainly sticks out here with the target to become 100 percent renewable by 2020 (this includes hydropower). Other examples are Ethiopia with a target above 1GW of wind energy by 2020 and 2,5GW by 2030; Egypt with 22 percent of renewables by 2022. Morocco, 52 percent from renewable sources by 2030. Tunisia 30 percent also by 2030.

Similar to other emerging wind markets, there are different allocation programs in place to reach the targets and there is not a common trend: Egypt and Kenya offer a Feed-in-Tariff, while other markets offer auction or tenders, for example, South Africa which has been running a solid procurement program (REIPPP) over the past years tendering over 6 GW of capacity until today or, most recently, the 200 MW tender launched in Tanzania.

In South Africa, the success of the Renewable Energy Independent Power Procurement Programme (REIPPP) is contributing to the country’s target of producing 7000 MW of renewable energy by 2020 and 17,800 MW by 2030. And so far, 2 GW of wind energy has been installed.

However, the market has stalled: For once, the state-owned utility Eskom is facing financial challenges that impacts the signing of PPAs for already tendered capacity. Further, a revision of the Integrated Resource Plan (IRP) is still outstanding and will provide more clarity about the future volume expectations for wind energy; and thus, the expected volume for future procurement rounds.

During 2018 and 2019 (so far) no new wind capacity has been connected in South Africa. However, based on current market activity, GWEC Market Intelligence expects new installations to commence again during 2020 and onwards realising the already tendered capacity. The country needs this new capacity and wind energy is the most competitive source.

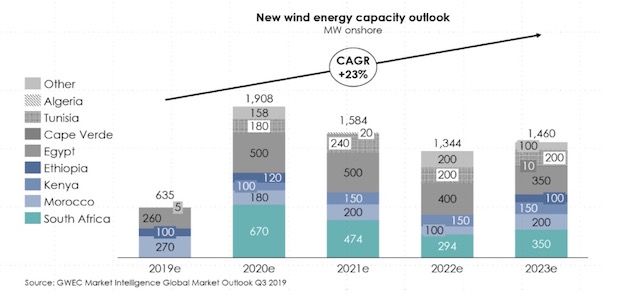

This forecast proposes that the total installed base of wind energy would more than double on the African content until 2023. GWEC Market Intelligence, however, sees materially higher potential based on governments fulfilling their targets; fostering regional integration and the role of regional power pools; available wind resources; momentum that Africa is living and consequent Africa-focused initiatives that are being launched and the wind’s cost-competitive position to drive economic growth in Africa. The absence of both long term energy planning and supportive frameworks and an equal playing field compared to other energy sources is hindering wind to fulfill its potential. This includes access and investments to transmission, lack of dispatch principles to prioritise wind energy as well as keeping fossil fuel subsidies – which are common bottlenecks in emerging and developing markets across the world.

GWEC’s Africa Task Force is working to promote the case of wind energy for the African content, highlighting benefits such as the provision of clean and sustainable energy solutions while enhancing the development of a sustainable local value chain.

Source: Saurenergy.com

In a key step toward advancing clean energy adoption, Ahmedabad headquartered IRM Energy Ltd has…

Biofuels conglomerate Aemetis has announced that its subsidiary in India – Universal Biofuels – has…

The Greater Noida Industrial Development Authority (GNIDA) has commenced construction of a 300-tonne-per-day (TPD) bio-CNG…

The World Earth Day – with this year’s theme on ‘Our Power, Our Planet’ –…

In a significant step toward promoting decentralized waste management and clean energy, Tata Steel UISL…

Jaipur headquartered bioenergy player Rajputana Biodiesel Ltd has announced that its subsidiary, Nirvaanraj Energy Private…