Will 2019 be the year of Rooftop Solar?

For the solar sector in India, 2018 will evoke mixed feelings. While the first quarter of the year saw solar Installations crossing 3 GW, the next two quarters at best were only able to match the first quarter, combined. Yet, it was still enough to place India second in the world when it came to solar installations in the first nine months of 2018. However, industry experts still remained restrained on the solar scenario in the country and that was because of two reasons. One, in possibly the biggest disruption of the year among many, the imposition of the Safeguard Duty on the import of solar equipment from China and other ‘developed countries’, and second, the continuous tinkering in policy and more, with an inexorable push to drive down prices that eventually seems to have stifled growth. Will 2019 be the year of rooftop solar?

The one bright spot, if it can be called that, was the Rooftop segment. The segment finally seems poised to grow, thanks to the welcome combination of multiple new entrepreneurs who see potential here, as well as the drop in prices and continued subsidies, that make this an attractive proposition at scale.

According to a report by the consultancy firm Bridge to India, India added 1,538MW of rooftop solar capacity in the 12-month period up to September 2018. A gargantuan 75 percent increase year-on-year, saw it record the highest capacity addition over a 12 month period. Another report from the same firm highlighted that rooftop solar is experiencing a growth rate of nearly 70% annually. And singled out the following reasons for its growth: Being unaffected by policy uncertainty and not reliant on available land or transmission infrastructure, benefiting from sharp falls in module prices, which have plunged 30% in the last nine months. The same report reveals that India is expected to deploy just 4.1 GW of solar in the financial year 2018/19, down 55 percent year-on-year, covering only a quarter of the quota set out by the government for each financial year (16 GW) as it seeks to achieve its ambitious targets for 2022.

After a long period of marginal progress, the end of 2018 saw a burst of activity. The rapid increase was mostly forced by the commercial and industrial (C&I) sector which dominated with nearly a 70% share of the market, while residential still only accounted for a 9% market share.

While utility-scale projects seem to have hit a wall, rooftop seems to be finally taking off. Vinay Rustagi, managing director of Bridge to India, said, “75% market growth in a year plagued by safeguard duty and GST uncertainty is absolutely fantastic. Ongoing fall in module prices should continue to drive growth in the next few years. Rooftop solar has huge growth potential and should be given more policy support particularly when utility-scale solar is increasingly facing acute land and transmission connectivity challenges. Proactive government intervention can help in boosting growth and realizing the full potential of this compelling energy source.”

Firms like Tata Power and Cleanmax solar declared serious retail plans as leaders in the CAPEX and OPEX models, even as existing small installers also reported an uptick in orders. Presenting the buyer with multiple options in selecting a provider that best fits the bill. We presented a comparative study in September, Solar Rooftop Price Shopping, Which is the Best Solution For You? which attempted to help find customers the best match.

In September, one of the world’s leading solar module manufacturer Trina Solar announced their entry into the Indian rooftop sector with its TrinaHome service. Gaurav Mathur, India-Director of Trina Solar said, “The reason we decided to move into the household sector, is because we can see there is an enormous market opportunity to bring solar energy to Indian consumers.”

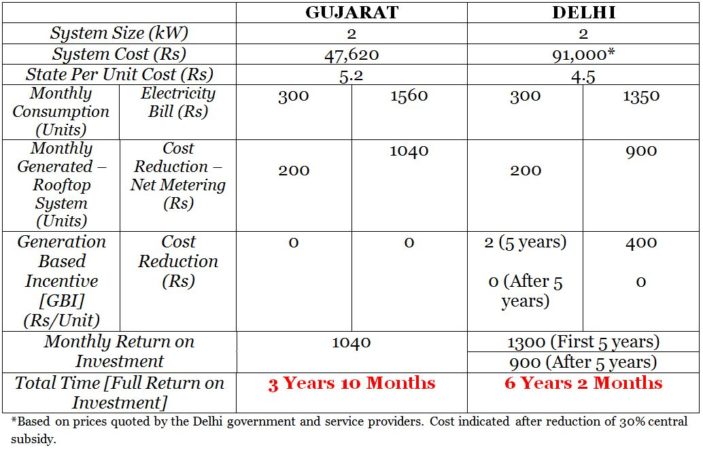

This matched by Solar policies released by some states and of late the Solar Energy Commission of India’s (SECI) 10 GW Grid-Connected Rooftop Solar PV System Scheme for Government Buildings have been a part of the catalyst for the recent burst in activity which has seen Colleges, Government Institutions and even metro rail corporations betting big on rooftop solar. The most notable state solar policies were released in Delhi and Gujarat, where one targetted the RESCO model for housing societies while the other banked on transparency across the board by revealing fixed final prices for customers along with additional subsidies. In one of our research report, we found, in the matter of the return of investments the Gujarat policy had Delhi beat, and by a comfortable margin. So while Gujarat might be a much more profitable market for Individual consumers, Delhi has its benefits for group housing societies and institutional buildings with subsidized rates of power thanks to net metering and GBI.

Pranesh Chaudhury, Founder, Zunroof, a Gurugram based solar rooftop solutions provider which claims to have the maximum number of installations in North Indian states said, “I think prices are now exactly right and bottomed out for residential clients to put solar on their roofs. They just have to be careful with fly-by-the-night-operators (the likes who have not even 10 reviews on google but claim 100s of installations) and ensure they get the system designed and diagnosed correctly – their improved satisfaction with going solar process will drive adoption in their neighborhoods. I believe this could be the year that rooftop will finally take off and we’re betting big on it, we are hopeful that ZunRoof will grow 5 times this year.”

Amol Anand, Co-Founder, and Director of Sales, Loom Solar -with a strong online presence, “There is a massive opportunity right now for rooftop solar in India. There is no doubt in my mind that 2019 is going to be a breakthrough year for the sector, but there are a few issues which are currently not helping the cause. The government doesn’t tally or consider any off-grid capacity, and from what we’ve noticed over the past 9 months is that off-grid firms like Luminous and Exide have the highest revenue across the sector. Luminous which has the largest market right now has doubled its revenue in the last 9 months.“

The cumulative installations reached 3,399MW by the end of September this year, and are projected to reach 15.3GW by March 2022. Considerably smaller than the planned 40 GW target set by the government for 2022, but still showing signs of progress over previous assessments which predicted far worse. 2/40, Why the government is flunking rooftop solar.

“Off-grid offers people the luxury of not having to deal with the govt. for permits etc, they simply get it installed and start using it immediately. Word of mouth is the key driver in the segment. What on-grid now needs is to try and match the ease with which solar can be accessed by the public. And the biggest problem for rooftop solar right now is Net-Metering, no one wants to wait for 3-4 months and have their money just get caught up in the system.”

“The buyers are there and they are interested, the companies have laid out nice campaigns and everything points to the fact that it’ll be a big year, but what could help the segment absolutely explode is a policy that mandates installation of net-meters in no more than 10 days. Take for example the capital, ever since the state government made the entire process of application etc online the numbers have shot up, more and more installations are happening every day. There needs to be a similar policy change pan India and when that happens, there will be no stopping the rooftop solar market. 2019 will be a landmark year for rooftop solar, we expect to grow by 2 or 3 times, but with policy changes in net-metering and payback period for subsidies it can expand even further.” Amol added.