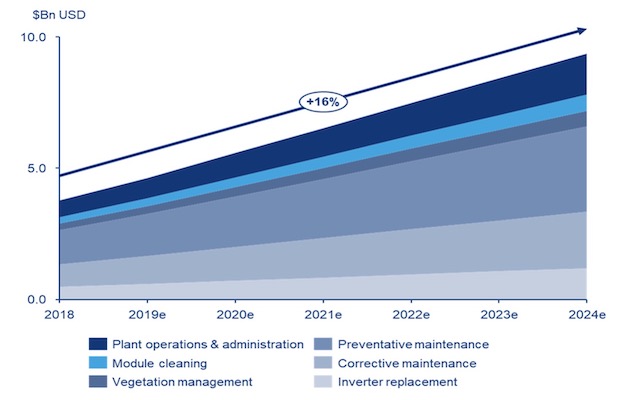

According to a new report, annual solar plant operations and maintenance (O&M) costs will grow from nearly USD 4.5 billion in 2019 to just over USD 9 billion in 2024, presenting a USD 16 billion opportunity.

The report by research agency Wood Mackenzie predicted that the increase in the O&M costs will be due to the future demand growth and current installed capacity. And that unplanned repairs alone can cost owners up to USD 3,000/MW/year, based on an average-sized solar power system of 50 MW capacity.

After a modest decline in 2018, the global cumulative solar PV installations are expected to grow from ~500 GW in 2018 to 1,243 GW by 2024. China, India and the US concentrate more than 50 percent of global solar PV installations to 2024, making both APAC and North America the most attractive regions within the solar O&M segment.

Solar installations nearing inverter end of life will reach 21 GW by the end of 2019, representing 3.4 percent of the global market. This increases to more than 14 percent of the total cumulative capacity over the following five years. By 2024, the report expects the solar industry to have 176 GW of projects with inverters older than ten years.

Despite being the most significant and major component of a solar project, the replacement of a solar inverter represents only 12-13 percent of the average O&M cost of a ~50MW solar power system. By 2024, inverter replacement costs alone will reach nearly USD 1.2 billion out of a total O&M opportunity of USD 9.4 billion. Other areas that have a significant impact on costs are regular preventative maintenance and corrective repairs, representing 35 percent and 24 percent respectively.

“As asset owners and operators continue to invest in advanced analytics and O&M specific software, and move from more time-consuming methods of spreadsheet-based analytics, operational costs will be reduced and higher data quality achieved,” said Leila Garcia da Fonseca, Wood Mackenzie principal analyst.

The report further adds that the future is undoubtedly digital. Nevertheless, not all facilities and asset owners are ready to implement digital solutions. “It doesn’t make sense for owners of projects close to end-of-life to deploy an expensive and intelligent platform. It wouldn’t make sense technically, nor commercially, as the data acquisition system might not support all-digital system requirements. The economics just don’t add up,” said Fonseca.

In order for big data adoption to ramp up, two things need to happen according to the report. Asset owners must realise the benefits a digital platform can bring to their asset management tasks. Additionally, results from systems with established advanced analytics must be more widespread among the industry.

In a key step toward advancing clean energy adoption, Ahmedabad headquartered IRM Energy Ltd has…

Biofuels conglomerate Aemetis has announced that its subsidiary in India – Universal Biofuels – has…

The Greater Noida Industrial Development Authority (GNIDA) has commenced construction of a 300-tonne-per-day (TPD) bio-CNG…

The World Earth Day – with this year’s theme on ‘Our Power, Our Planet’ –…

In a significant step toward promoting decentralized waste management and clean energy, Tata Steel UISL…

Jaipur headquartered bioenergy player Rajputana Biodiesel Ltd has announced that its subsidiary, Nirvaanraj Energy Private…