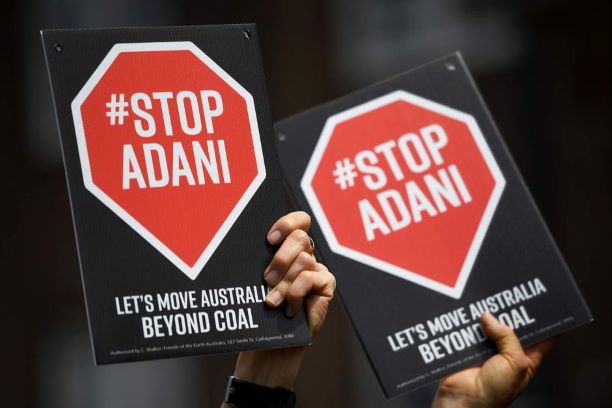

Carmichael Project Draws Massive Resistance

In a decision that might yet go down as a historic blunder, or the last of such, Siemens announced yesterday that it would go ahead with plans to provide rail infrastructure for the Carmichael mine in Queensland. The announcement was made by CEO Joe Kaeser himself, pointing to the escalation the issue faced at both Siemens and earlier, with the Australian government.

The decision drew an immediate response with activists of the “Fridays for Future” movement responding by protesting in front of the company’s offices in 15 German cities, including Berlin, Hamburg and Munich.

With the United Nations saying that emissions must decline more than 7.5 percent annually in order to hit the 1.5C temperature goal laid out in the 2015 Paris deal, Siemens was clearly aware of the backlash it would face.

For Siemens, which aims to be carbon neutral by 2030, the decision couldn’t have been an easy one. It had signed the contract in December to provide rail signalling services for the Carmichael project, despite warnings at the time too, and was clearly doing it with the understanding that not doing it would simply mean allowing a competitor to do it.

Resistance to the project would have only sharpened, and will in fact probably not end anytime soon, despite this further move forward.

The massive bush fires which have caused unprecedented damage and destruction across Australia are still to die out, and a proper reckoning of losses awaits Australians there too. How they react after that to the Carmichael project remains to be seen, despite the project going through the full gamut of extended central, state level, and even judicial approvals. Through this whole journey, the one thing that stood out was that Australia simply doesn’t have an answer yet to its dependence on primary commodities exports, which has made it among the world’s leading coal exporters today.

The open-cut Carmichael mine is set to become operational next year and produce up to 27 million tonnes of coal annually, most of it meant for Adani’s thermal plants in India possibly.

After trying hard to secure international private finance for the coal mine , Adani had announced in 2018 that it was self-financing a smaller, $2-billion version of the project. Some funding has apparently been tied up through India’s largest government owned bank, State Bank of India.

Siemens CEO Kaeser had met with leading “Fridays for Future” activist Luisa Neubauer in Berlin on Friday and after the meeting, had mentioned he was “on the same side” as environmentalists.

Neubauer herself, besides Greta Thunberg blamed Siemens for missing a huge opportunity to make a difference.

The decision by Siemens might even have been inspired by the trajectory Adani itself has taken, where it has pointed to the higher quality of Australian coal to justify its use in India, one of the world’s highest polluted countries and biggest users of coal for energy.

Adani has also diversified away from thermal power in recent years, pushing aggressively into solar and wind energy, where it has quickly built up one of the largest portfolio of projects in operation and in the pipeline in the country.

It’s a move that is happening across the sector, with erstwhile giants in the thermal space like the state owned NTPC (targeting 10 GW of renewables by 2022) and rival Tata Power also investing much more intensively into renewables now.

In fact, with legacy players effectively owning the largest chunk of renewables capacity and pipeline, there have been serious doubts raised on the impact this was likely to have to on the pace of transition to more renewable energy, faster.

In a significant move toward advancing green energy and industrial growth in the state, Himachal…

Golabl chemical conglomerate BASF has announced that its now offering the world’s first biomass-balanced polyethersulfone…

In a crucial stint to bolster the biogas sector and sustainable dairying in the country,…

TotalEnergies SE has received approval to proceed with its Middlebrook solar and battery project in…

Andhra Pradesh Chief Minister Chandrababu Naidu has inaugurated the Rs 1,000-crore green hydrogen plant of…

The BITS Pilani has developed an innovative solution for managing landfill leachate, domestic septage, and…