Top Oil and Gas Companies Jointly Invested 1% on Green Energy in 2018

The Right Idea. Reality is opposite.

The Right Idea. Reality is opposite.

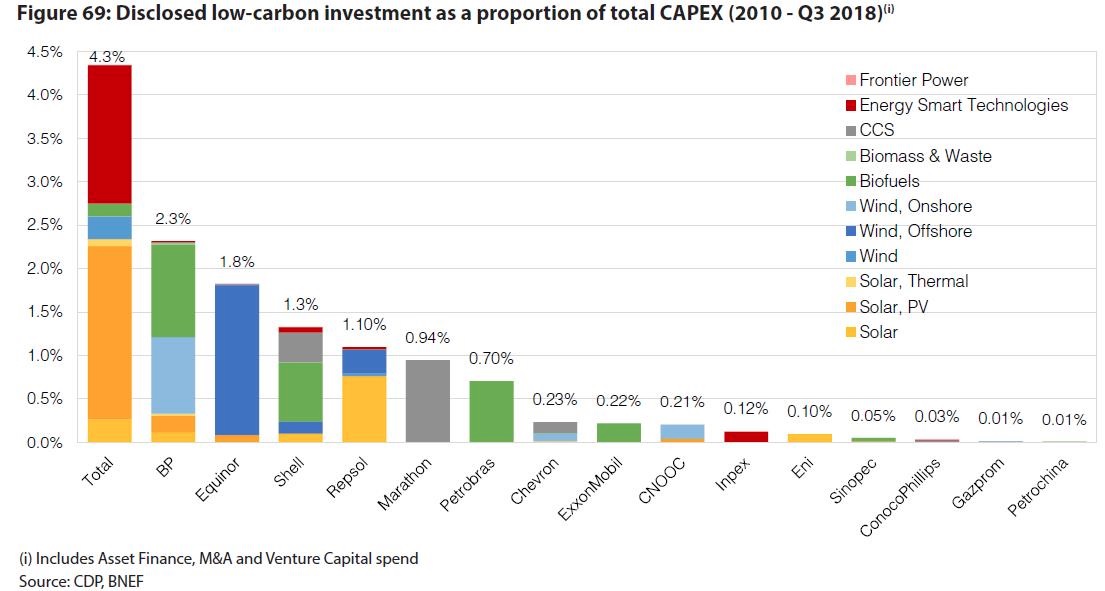

A recent study conducted by CDP, a climate-focused research provider that works with major institutional investors, revealed that top oil and gas companies jointly spent around only 1 percent (1.3 %) of their 2018 budgets on clean energy.

Companies such as Royal Dutch Shell, Total and BP which are amongst the top publicly-listed oil and gas firms in the world, have only recently started accelerating spending on wind, solar as well as battery technologies, to align themselves with the ongoing global efforts to cut down carbon emissions in the battle against global warming and climate change. However, for all the noise around these, the firms continue to invest much more in their existing businesses.

Read: Final Warning from Earth? Time to listen and act

Investors in recent years have turned on the pressure on boards of fossil fuel companies to diversify their investment strategies with a focus on cleaner energy sources which will help bring in a necessary offset in the energy market to counter fossil fuels in the future. Including firms like Exxon Mobil, the world’s largest publicly-traded oil company, having been extensively pressured to reduce emissions, spend more on low-carbon energy and increase disclosure on climate change. More recently, the state of New York filed a lawsuit alleging that Exxon defrauded investors regarding the financial risks the company faces from climate change regulations. The New York state attorney general targeted Exxon Mobil (XOM) over global warming claims.

The study also revealed that investments by European firms massively outpaced their U.S. and Asian rivals. Europe’s oil majors account for around 70 percent of the sector’s renewable capacity and nearly all the capacity under development today. “With less domestic pressure to diversify, U.S. companies have not embraced renewables in the same way as their European peers,” CDP said in its report.

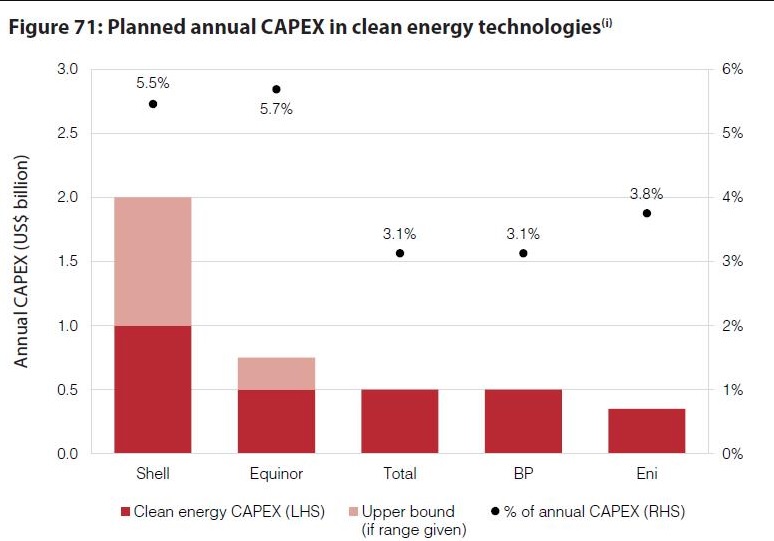

In terms of capital investments, Netherland’s Shell leads the rest with future plans to spend close to $1-2 billion per year on clean energy technologies out of a total budget of $25 to $30 billion However, Ben Van Beurden, CEO Shell, speaking at conference in London recently, warned the industry not to be swayed by the flurry of headlines marking Shell’s steps towards cleaner energy. “Even headlines that are true can be misleading, they might even make people think we have gone soft on the future of oil and gas. If they did think that, they would be wrong,” he said. Speaking a day after UN’s climate report calling for an urgent response to limit greenhouse gas emissions, the CEO reaffirmed the delegates that when it comes to oil and gas, Shell still “means business”.

Norway’s Equinor (formerly Statoil) plans to spend 15-20 percent of its budget on renewables by 2030, while France-based Total has spent the most on low-carbon energies since 2010, around 4.3 percent of its budget, according to the study. As a whole, however, the world’s top 24 publicly-listed companies spent only 1.3 percent of their total budgets amounting to $260 billion on low carbon energy in 2018. A very minute investment in the future of energy, but still nearly double the amount (0.68%) the group has invested in renewables between 2010 and 2017.