Solar Tops Board as RE Investment Skyrockets Ahead of $2.5 Trillion

- The decade of investment (2010‐2019) quadruples renewables capacity from 414 GW to about 1,650 GW

- Solar capacity alone will have risen to more than 26 times the 2009 level — from 25 GW to an estimated 663 GW

- 2018 capacity investment reached USD 272.9 billion, triple the investment in fossil fuel generation

- Renewables generated 12.9 percent of global electricity in 2018, avoiding 2 billion tonnes of carbon dioxide emissions

On the course to hit $2.6 trillion dollars, the global investment in Renewable energy is surely entered the golden era after 10 years. Shining bright is the poster boy of the renewable energy—Solar Power—with more gigawatts of power capacity installed than any other generation technology, according to new figures published on 5th Sept.

The Global Trends in Renewable Energy Investment 2019 report, which was released strategically ahead of the UN Global Climate Action Summit carried the good news for all.

That’s not all, this investment is set to have roughly quadrupled renewable energy capacity (excluding large hydro) from 414 GW at the end of 2009 to just over 1,650 GW when the decade closes at the end of this year.

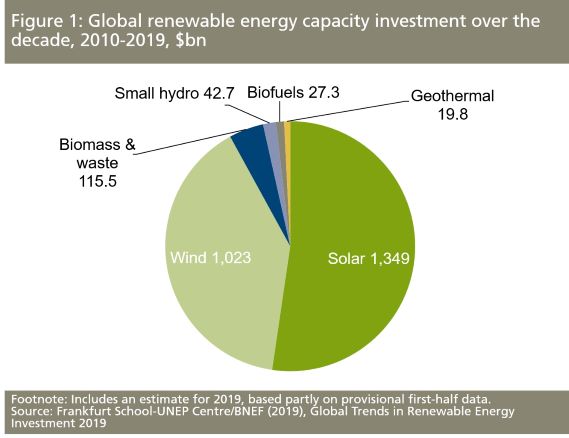

Growing at a dizzying 26 times, solar alone will have grown from 25 GW at the beginning of 2010 to an expected 663 GW by the close of 2019 — enough to produce all the electricity needed each year by about 100 million average homes in the USA. The sun did not set for solar as it will have drawn half — USD 1.3 trillion — of the USD 2.6 trillion in renewable energy capacity investments made over the decade.

If we look at the global picture, the Renewables’ electricity generation, reached 12.9 percent, in 2018, up from 11.6 percent in 2017. The small fraction of increase was enough to avoid an estimated 2 billion tonnes of carbon dioxide emissions last year alone — a substantial saving given global power sector emissions of 13.7 billion tonnes in 2018.

“Investing in renewable energy is investing in a sustainable and profitable future, as the last decade of incredible growth in renewables has shown,” said Inger Andersen, Executive Director of the UN Environment Programme. “But we cannot afford to be complacent. Global power sector emissions have risen about 10 percent over this period. It is clear that we need to rapidly step up the pace of the global switch to renewables if we are to meet international climate and development goals.”

According to the report, including all major generating technologies (fossil and zero‐carbon), the decade is set to see a net 2,366 GW of power capacity installed, with solar accounting for the largest single share (638 GW), coal second (529 GW), and wind and gas in third and fourth places (487 GW and 438 GW respectively).

Jon Moore, Chief Executive of BloombergNEF (BNEF), the research company that provides the data and analysis for the Global Trends report, commented: “Sharp falls in the cost of electricity from wind and solar over recent years have transformed the choice facing policy‐makers. These technologies were always low‐carbon and relatively quick to build. Now, in many countries around the world, either wind or solar is the cheapest option for electricity generation.”

The cost‐competitiveness of renewables has also risen dramatically over the decade. The Levelized Cost of electricity (a measure that allows comparison of different methods of electricity generation on a consistent basis) is down 81 percent for solar photovoltaics since 2009; that for onshore wind is down 46 percent.

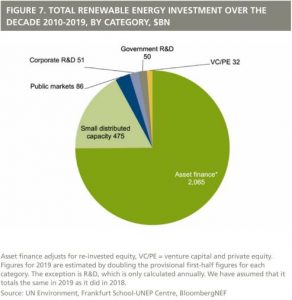

The report also tracks other, non‐capacity investment in renewables — money going into technology and specialist companies. All of these types of investment showed increases in 2018. Government and corporate research and development were up 10 percent at USD 13.1 billion, while equity raised by renewable energy companies on public markets was 6 percent higher at USD 6 billion, and venture capital and private equity investment was up 35 percent at USD 2 billion.

Overall renewable energy investment, including these categories as well as capacity investment, reached USD 288.3 billion in 2018, down 11 percent on the record figure of USD 325 billion attained in 2017.

To read the report click here