Solar Stars. China’s top 5 solar manufacturers

Published on: Apr 9, 2018

When it comes to Solar Energy, China has an unbelievable role in the growth the sector has seen, be it in installation, generation or investment. The country has consistently topped all three metrics for the past few years. But powering this has been the country’s stranglehold on manufacturing, an area where it dominates overwhelmingly, so much so that it has made many countries even uncomfortable over teir dependence on this manufacturing giant. So let’s know more about the firms behind China’s rise and utter dominance of the solar sector.

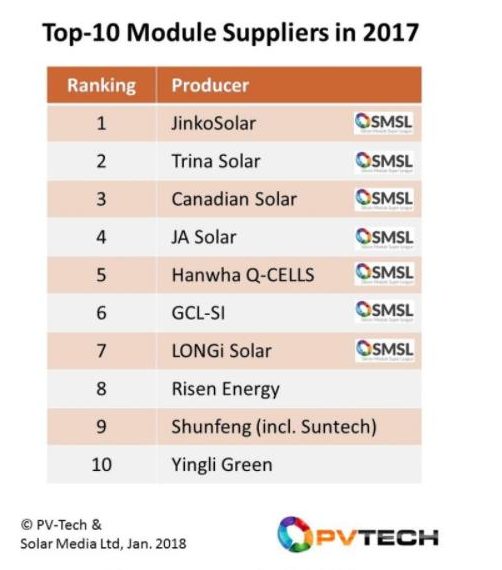

In 2017 alone, the contribution of Chinese companies to the top 10 module suppliers was greater than ever seen before in the PV (photo voltaic) industry. 9 of the top 10 solar manufacturers in the world are from China or have Chinese origins. The underlying reason for this dominance is the fact that China holds more than 50% of the global end product market for modules, and the Chinese market only deals with Chinese manufacturers. Another reason being that most of the top module suppliers have company-run operations in South-east Asia or OEM arrangements in Vietnam (China financed) which helps overcomes both European and US legacy import restrictions.

Here is a quick profile of the top 5 solar panel producers in the country that boasts of over 400 different manufacturers.

JinkoSolar

Starting as a wafer manufacturer in 2006, JinkoSolar is now a producer of Photovoltaics and developer of Solar Projects. With its headquarters in Shanghai, the company has 8 international production sites and has a vertically integrated solar product value chain.

According to numbers reported by the company’s spokesperson the integrated annual capacity of Jinko at the end of 2017 was,

– 8 GW for Ingots and Wafers

– 5 GW for solar cells

– 8 GW for solar modules

The two frontline products of the company are:

1. Eagle Black – A nano-scale etched module with a light-absorption rate of 99.7%.

2. Eagle Dual – A dual-glass module that has low degradation rates.

The company guarantees a 20.13% cell efficiency for each polycrystalline PV module. So far distribution are at 12 GW worldwide making them the world’s third largest crystalline module producer while having the most economical production line. The company also provides electricity with approximately 1,314 MW of Solar Power connected to the grid till date.

Trina Solar

Trina Solar is one of the largest module manufacturer and distributor. Founded in 1997 the company has delivered close to 32 GW of Solar modules worldwide, accounting for more than 10% of the global market share. This makes Trina the largest solar module supplier in the world.

At the end of 2016 the vertically integrated solar photovoltaic manufacturer reported an annual manufacturing capacity of,

-1.5 – 2.5 GW for Ingots and Wafers

-5 GW for PV cells

-6 GW for PV Module

The flagship product of the Company the Honey M Plus comes in both mono- and multicrystalline options with a peak efficiency of 19.2% and a 10 year guarantee. The company has a 1267.6 MW grid connection in China and a massive 31 MW grid linkage in Europe.

The company recently announced that its European entity had reached 1GW of module shipments in 2017 and the managing director of the European MBU Mr. Gonzalo De la Viña said, “Trina Solar has proved its position in the solar industry as a leading module manufacturer, and at the same time a world class downstream player.” Also adding, “We are very pleased to say that the modules we shipped in 2017 have been installed in various projects in our vastly different markets, which could reduce an estimated 700,000 tonnes of carbon dioxide emissions a year.”

JA Solar

Based in Shanghai, JA Solar manufactures and sells solar cells and solar modules. Founded in 2005, it now has 8 production facilities worldwide and an all-time global shipment value of 23GW, with key market shares in China, Japan, Europe and USA.

The company reported its annual module production capacity to have reached,

– 3.0 GW for Silicon Wafer

– 6.5 GW for Solar Cells

– 7.0 GW for Solar modules

The breakthrough product for the company was the Salt Mist resistance PV modules which cleared the Double standard Salt Mist corrosion test (IEC 61701). The company believes in providing standard products but instead of adding enhancements they strive to improve their efficiency and bankability (91%) which was ranked 6th amongst all module brands by Bloomberg.

Recently reaching the landmark of 1GW module shipments in India. Mr Baofang Jin, Chairman and CEO of JA Solar said, “India is emerging as one of the largest PV markets in the world, and JA is well-positioned to continue to capture market share in the region. We remain focused on driving the R&D innovation that improves our products, which result in reliable modules and professional service to clients.”

Canadian Solar

Even though based out of Canada, the company has bulk of its manufacturing in China. A manufacturer of solar PV modules and provider of solar energy solutions. Founded in 2001, it is now one of the top 3 global module brands based on revenue having sold 70 million plus units over the past 16 years at a cumulative capacity of 22GW.

It also boasts of a geographically diverse pipeline of utility scale power projects which currently stands at 12 GW.

The company’s annual manufacturing capacity as of 2017 was reported to be,

– 400MW-1GW for Wafers

– 2.2-2.4 GW for Solar cells

– 4.33-5.8 GW for Solar modules

(IGI Airport Project, PC: Canadian Solar)

The company was selected as the sole photovoltaic module supplier for 2.1 MW solar power plant at the Indira Gandhi International Airport in Delhi. In 2017, the company increased its net revenue by almost 50%, shipping a record high of 6828 MW solar modules.

Longi Solar

Headquartered in Xi’an, Longi Solar is the largest supplier of mono-crystalline silicon wafers in the world. Established in 2000 the shipment scale of the company is at 3.2 GW presently having championed a cheap form of mono-crystalline silicon technology.

Production capacities reported at the end of 2016 were,

– 7.5 GW for Ingot and Wafer

– 2.5 GW for PV cells

– 5 GW for PV modules

The flagship product the 60-cell PERC module achieved a photoelectric conversion efficiency of 20.41%, which is a new world record for mono-crystalline PERC module.

Other notable manufacturers in the field include Risen Energy, Shunfeng and Yingli Green all key members of the ever growing industry.

![]()