Nearly 3 GW of solar projects, worth Rs 16,000 crore, could be at risk of penalties for missing their respective scheduled commercial operation date (SCOD) if the impact of Coronavirus on trade with China prolongs, a CRISIL analysis shows.

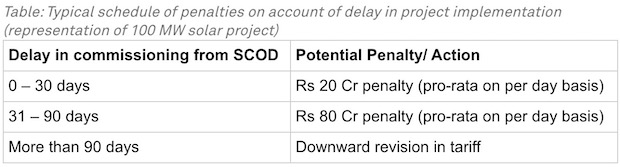

As per the standard terms of power purchase agreements, non-adherence to completion timelines attracts penalties, including downward renegotiation of tariffs. A typical schedule of penalties on account of delay is given in the table below.

For the record, India sources nearly 80 percent of its solar modules from China, where trade has been impacted due to measures implemented to combat the spread of the virus. The analysis revealed measures such as the restricted movement of people and/ or shut down of factories have disrupted module manufacturing in China and its feeder industries.

The clampdown has forced several manufacturers to run their plants at low utilisation, or to stall operations altogether. Indeed, even the modules already manufactured are facing delays in transit to project sites on account of precautionary restrictions on transit at ports.

Manish Gupta, Senior Director CRISIL Ratings said that this puts at risk around 3 GW of solar projects auctioned between July and August, 2018, which need to meet their SCODs by July 2020. Given that orders for modules are typically placed with a lead time of six months from SCOD, these projects are now in the process of either placing orders or receiving delivery of modules. Hence, any delay at this stage can prove costly.

In a bid to meet the commissioning timelines, the developers may choose to implement projects with more expensive modules sourced from locations other than China. But this could erode returns as the modules may be 15-20 percent costlier, shaving as much as 3 percentage points off their returns. Also, developers can invoke the ‘Force Majeure’ clause in the PPA under which they can seek relief under unforeseen and uncontrollable events. However, this is yet to be tested and may face legal and regulatory hurdles.

Ankit Hakhu, Director CRISIL Ratings said that “in the context, CRISIL’s credit outlook will be sensitive to any significant delay in opening up of trade with China, and consequently, delays in project implementation.”

Click here to read our previous story – Will CoronaVirus Prove To Be The Force Majeure Of 2020 for Indian solar?

Source: saurenergy.com

India is undergoing a significant influx of urban migration and a reclassification of rural areas,…

India’s quest toward green hydrogen economy received a significant boost with a strategic MoU between…

A new report by S&P Global has revealed that India’s growing biofuels industry is emerging…

In a significant breakthrough for India’s renewable energy and dairy sectors, dairy major Amul has…

Renewable energy conglomerate Anaergia Inc, through its subsidiary, Anaergia S.r.l., entered into a contract with…

Reliance Industries Ltd (RIL) Chairman Mukesh Ambani has announced a massive ₹75,000 crore investment in…