Renewable Push: India To Launch Transmission Line Tenders Worth $5 Billion

Pending Upgrades soon!

Pending Upgrades soon!

According to agency reports, India plans to launch $5 billion of transmission-line tenders in phases, beginning in June this year. The move is aimed to route a targeted 175 GW of power from renewable sources into the country’s grid by 2022, Anand Kumar, secretary at the ministry of renewable energy said.

India, which saw emissions rise by 4.8% or 105 Mt in 2018, is the world’s third-largest emitter of greenhouse gases. It has pledged to cut emissions and have clean energy account for at least 40 percent of its installed capacity by 2030, up from 21.4 percent now. The way seems arduous as country’s emissions are power driven and a gradual shift from coal to Renewable sources have propped up various problems such as DC to AC conversion, Load handling, Transmission loss rate. For absorbing a greater percentage of variable renewable energy (VRE), i.e. solar and wind, the grid needs to operate differently.

India’s renewable energy targets require investment in feeder lines and infrastructure upgrades. According to estimates, India has awarded tenders for about 12 GW of transmission lines since December, while bids for a further 16 GW will be launched by the end of June. Another 38 GW will be bid out before March 2020, Anand Kumar said.

For building transmission lines for 66 GW worth projects, an estimated investment of Rs 430 billion is needed, Kumar adds.

With about 300 clear, sunny days in a year, India receives twice as much sunshine as European countries, which is why it wants to make solar central to its renewable expansion as part of the fight against climate change. The government has set a Solar power goal of 100 GW and for wind 60 GW by 2022. The other 15 GW are to come from biomass and hydropower.

Research groups like WoodMac and CRISIL have been sceptical about India meeting its ambitious targets. They highlight policy issues, including cancellations of auctions of tenders, rights to land use and tariffs may force India to fall short.

Till date, India has cancelled tenders for renewable energy projects with a capacity of at least 5 GW, saying the bid prices were too high. Solar and wind energy developers have also complained about the difficulty of leasing land and duties on solar equipment imports.

But Kumar says the government must be careful not to buy power at any cost. “The mandate of the government is that we should buy power at a competitive price which is affordable,” he said.

To overcome these roadblocks, the government has been in talks with various states to ensure easy land availability. It has asked distribution companies to borrow from the government-run Indian Renewable Energy Development Agency to ensure timely payments to power producers.

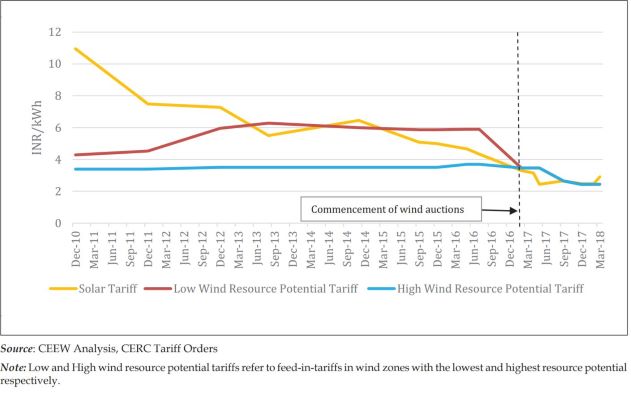

“Earlier tariffs were about 6.17 rupees per unit and now we are getting bids as low as 2.44 rupees a unit,” Kumar said, adding that India was ahead of its internal target to award 135 GW of renewable energy projects by March 2019.

“Projects of 103 GW have been installed or are under implementation, and over 37 GW are under various stages of bidding,” he said, adding that bidding for the targeted renewable energy addition would be completed by March 2020.

A renewable energy project typically takes two years to build. Kumar expressed confidence that bidding for the remaining projects would be finished by March 2020 and help India meet its 2022 target. This will ensure that India will be able to lower its coal use and Oil imports for diesel power generation.

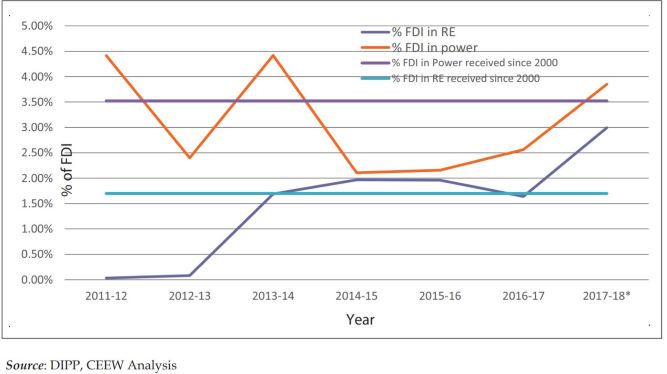

None of India’s private power producers plans to invest in new coal-fired power plants in at least the next five years. Almost all of India’s new capacity addition is expected to come from renewable energy. Power sector that has also caught the attention of foreign investors is RE generation. The percentage of FDI in RE generation has almost doubled from its average value since 2000 (1.7%) to 3% in the last fiscal year.

Thermal power plants currently account for about three-quarters of overall generation and about two-thirds of its installed capacity.

(with inputs from agencies)