Read the lines

The news that the Madhya Pradesh Electricity Regulatory Commission (MPERC) has refused the plea from the state electricity distribution companies’ (discoms) to revise the rates at which they procure wind power is to be welcomed.

The MP Power management company — the holding entity of the state’s discoms, had made a plea to review the regulators March 2013 order, that established a levelised tariff of `Rs 5.92 per unit for power for 25 years, for procurement from wind energy projects commissioned from the date. A second area of contention was the discoms right to refuse any additional power supplied by the producers, that is produced above their rated capacity or NUF, or normative utilisation factor. The discom basically tried to draw a link between the increase in NUF to 23% allowed in a 2016 tariff order, from 20% in 2013. The new levelised tariff was set at rs 4.78 accordingly, which was where the discom wanted the new rate to go to also.

Citing the Union power ministry’s 2017 guideline on wind power procurement, the regulator declined to consider the plea.

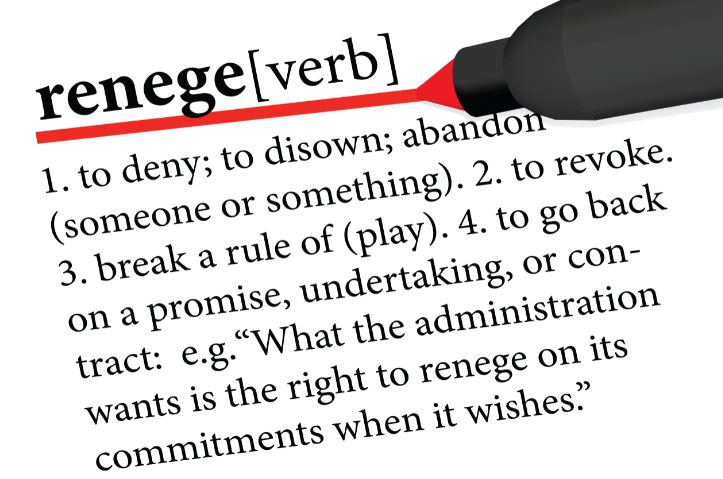

However, it is worrying that a petition like this was even considered, as clearly, loss making discoms have no idea about the massive damage they can cause to the sector by this kind of behaviour. For understanding this, they need to look to South Africa, where the renewable energy sector is threatening to go into a freeze, on rumours of the government asking power firms to renegotiate rates of 2011-12. The issue is the same. Miserable financials of the national discom, Eskom, which has left it desperate to reduce its liabilities, by any means possible. In this case, by considering what is blatant cheating on the firms that have invested in the sector.

It’s important for the government to ensure that PPA negotiations never come up for discussion post signing, except perhaps in force majeure cases. What has happened in Madhya Pradesh, or even Andhra Pradesh . In Andhra, the discom has made a somewhat similar attempt by approaching the state’s electricity regulator to change the parameters used to determine the tariffs of wind power plants in the southern state, where the agreed rate of Rs 4.84-a-unit tariff was arrived at through the earlier method.

While noone contests that technology and productivity have gone up massively in wind power generation, it is also noone’s case that when making earlier bids, investments and returns were calculated on the technology of the day. With current wind tariffs at sub Rs 3 levels in open bidding, it might sound very tempting to open up renegotiations. But to do that on old PPA’s would be an act as bad as default, as far as the investors behind those projects are concerned. No one wants to consider the implications of that on a sector that has been an undisputed bright spot for this government.

The curtain raiser for the 2nd edition of the India Bioenergy & Tech Expo (IBETE…

In light of the ongoing debate on whether flue gas desulphurisation (FGD) systems in coal-fired…

In a key step toward advancing clean energy adoption, Ahmedabad headquartered IRM Energy Ltd has…

Biofuels conglomerate Aemetis has announced that its subsidiary in India – Universal Biofuels – has…

The Greater Noida Industrial Development Authority (GNIDA) has commenced construction of a 300-tonne-per-day (TPD) bio-CNG…

The World Earth Day – with this year’s theme on ‘Our Power, Our Planet’ –…