LNG Market To Reach 490MMtpa by 2030

Not So Steady

Not So Steady

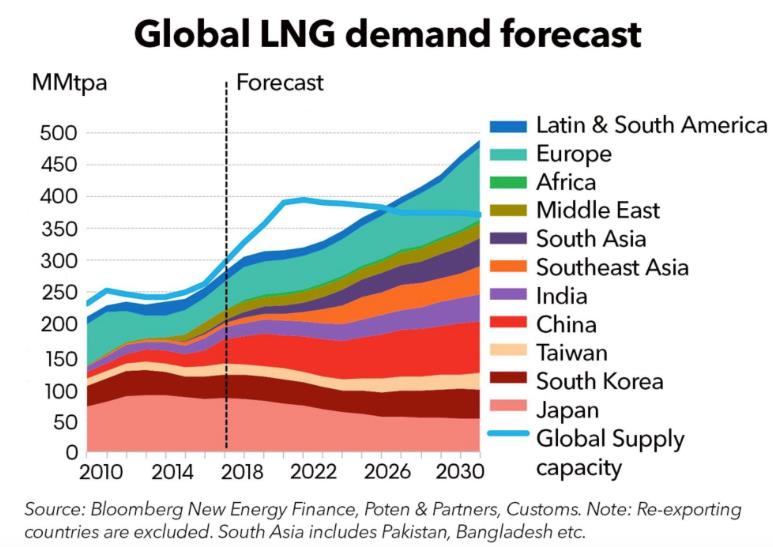

BNEFs (Bloomberg New Energy Finance) 2018 Global LNG Outlook predicts the LNG market to grow to an estimated 490MMtpa by the year 2030, which is a 207MMtpa leap from last year’s 285MMtpa.

2017 saw a 9.7% increase in LNG consumption as compared to 2016 i.e. the LNG consumption was approximately 25MMt more. Last year was recorded having the highest LNG consumption since the Fukushima incident with imports rising in 19 of the 29 countries involved in LNG imports.

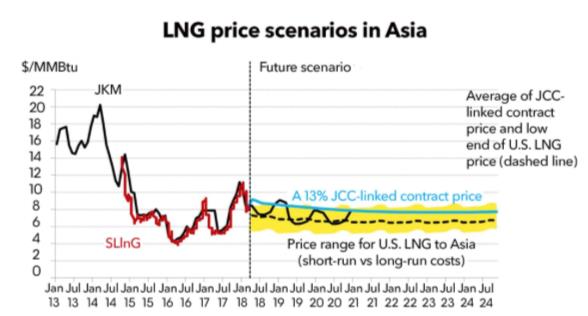

The study, however, indicates a slump in the LNG demand for this year with a further slowdown from 2019-22. It is worthwhile to note that supply overcapacity during this period seems to be smaller than before amid the delays in commissioning new projects. The growth during this period is expected to stabilize in the range of 314-330MMtpa.The demand for LNG is expected to grow after 2023 at a rate of 4-7% annually keeping in mind that a potential shortage can only be relieved if final investment decisions for new export projects worth 118MMtpa are made by 2020 (these projects are mainly in USA, Qatar, Mozambique, Papua New Guinea).

Ashish Sethia, global head of LNG analysis, said: “The growth rate in 2019-22 will slow as the commissioning of new gas pipelines from Russia absorbs some of China’s demand, and as more nuclear power comes online in Japan. Average utilization of export plants in 2021, when supply capacity reaches its peak, will likely be 81%, which is low by historical standards.”

The global LNG market is predicted to be over-contracted from 2018 to 2020 (the prediction is based on BNEFs base-case demand scenario). The base-case scenario estimates the maximum demand for new contracts to grow from 13MMtpa in 2022 to 297MMtpa by 2030. The global capacity is to peak by 2021, 396MMtpa, with Europe and Asia driving the market towards the 2030 estimated figure of 490MMtpa.

The report predicts Europe to be the largest LNG contract demand market, even though it is over-contracted till 2022. It shows a 94MMtpa of uncontracted demand by 2030.

“During 2018-30, European LNG imports are anticipated to grow faster than previously expected due to restrictions on production at the giant Groningen gas field in the Netherlands,” stated John Twomey, head of European gas analysis. “In the long term, declines in Dutch and Norwegian gas production and retirement of coal capacity will push LNG imports over 104MMtpa by 2030, as Europe aims to keep its reliance on Russian pipeline gas under control,” he added.

Asia is slated to continue to import 70% of the world’s LNG up to 2030. China is predicted to lead the Asian market by being the second largest potential market for signing term contracts, it is estimated to have an uncontracted demand of 40MMtpa in the coming decade. South Korea, India, Pakistan and Taiwan follow China with uncontracted demands of 32, 30, 22 & 17MMtpa respectively by the end of 2030. The report highlights that floating storage and regasification (FSRU) technology will continue to unlock demand in new markets, particularly South and Southeast Asia.

“In 2022-23, South and Southeast Asia will become the main driver for the world’s LNG imports, adding 11.7-13.6MMtpa of demand,” commented Maggie Kuang, head of Asia-Pacific LNG analysis and lead author of the report.

Links: Bloomberg New Energy Finance; Global Energy Outlook 2018

![]()