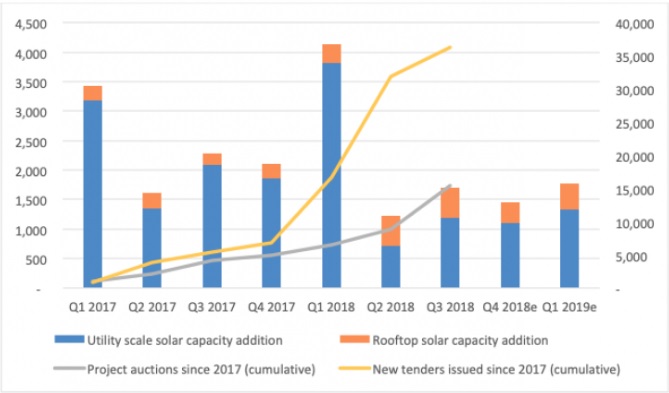

According to the latest report “India Solar Compass” from consultancy firm Bridge to India, India is expected to deploy just 4.1 GW of solar in the financial year 2018/19, down 55 percent year-on-year, covering only a quarter of the quota set out by the government for each financial year (16 GW) as it seeks to achieve its ambitious targets for 2022.

Softbank promoted SB Energy with 400 MW and ACME with 300 MW project installations led the capacity additions in the third quarter of 2018, whereas, Rajasthan led all the other states and accounted for nearly 55 percent of all capacity additions in the same period. India’s total installed PV capacity as of 30 September 2018, has now reached 27.4 GW off which 23.2 GW is from utility-scale, 3.4 GW of rooftop solar and 0.8 GW off-grid solar.

Vinay Rustagi, managing director, Bridge to India, said, “The Indian solar market has grown spectacularly over last four years but is struggling to sustain [that growth] because of policy and execution challenges. The slowdown is worrying for all stakeholders. We are witnessing increasing volatility in tender issuance, auctions and capacity addition because of poor coordination between different government agencies and constraints in transmission capacity and land acquisition. MNRE has not helped matters by failing to decisively address GST and safeguard duty issues. Arbitrary ceiling tariffs and poor tender design have resulted in tenders getting routinely cancelled and/or undersubscribed. As a result, the gap between tenders issued and auctions completed has been widening in the last year. Our revised best-case estimate for solar capacity by March 2022 is 67GW, well short of the 100GW target unless decisive remedial steps are taken immediately.”

Amid the slowdown in utility-scale capacity, the report further highlights that rooftop solar is experiencing a growth rate of nearly 70% annually. Unaffected by policy uncertainty and not reliant on available land or transmission infrastructure, the market segment is benefiting from sharp falls in module prices, which have plunged 30% in the last nine months.

Read: Solar Rooftop Price Shopping, Which is the Best Solution For You?

In a key step toward advancing clean energy adoption, Ahmedabad headquartered IRM Energy Ltd has…

Biofuels conglomerate Aemetis has announced that its subsidiary in India – Universal Biofuels – has…

The Greater Noida Industrial Development Authority (GNIDA) has commenced construction of a 300-tonne-per-day (TPD) bio-CNG…

The World Earth Day – with this year’s theme on ‘Our Power, Our Planet’ –…

In a significant step toward promoting decentralized waste management and clean energy, Tata Steel UISL…

Jaipur headquartered bioenergy player Rajputana Biodiesel Ltd has announced that its subsidiary, Nirvaanraj Energy Private…