India Proposes To Impose Anti-Dumping Duty On Malaysian Tempered Solar Glass

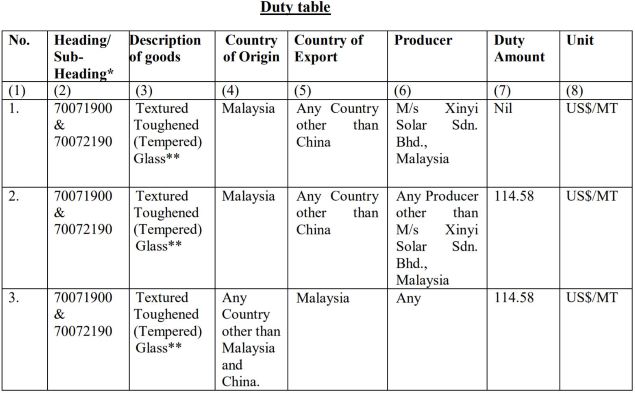

The Directorate General of Trade Remedies (DGTR) has released its final findings for the anti-dumping duty investigation concerning the import of textured tempered coated and uncoated glass from Malaysia. The DGTR has recommended levy of anti-dumping duty of $114.58/metric ton for a period of five years.

The Petition was filed by Gujarat Borosil wherein it said that the dumping of cheap products from Malaysia was causing material injury to its business, claiming to be the only solar glass producer in India. This landed Malaysian firms on the radar of DGTR.

The investigation was led by the DGAD which agreed that there was enough evidence to support Gujarat Borosil’s claim that solar glass was being dumped in the Indian market from Malaysia, potentially causing material injury to the Indian company.

The DGAD also agreed that there was evidence of a causal link between the alleged dumping and injury to the petitioner, which led them to initiate the anti-dumping investigation.

According to the directorate, under its Injury assessment “The domestic industry has suffered material injury during the injury period and period of investigation. This injury has been due to various factors including imports of tempered solar glass from Malaysia.”

“The domestic industry has suffered material injury on account of price suppression and undercutting by imports from Malaysia. The financial parameters on profitability and return on investment (RoI) are also noted to be adverse,” stated a DGTR release.

After reviewing the submissions made by all the parties and stakeholders, the DGTR noted that tempered solar glass that has been exported to India by one producer, namely Xinyi Solar, are non-dumped. The exports from non-cooperating producers other than Xinyi Solar, have been evaluated as dumped, and causing injury as well.

The DGTR did not find Xinyi Solar to be dumping as per the anti-dumping rules, therefore their exports to India are not liable for an anti-dumping measure. The non-cooperating producers for whom dumping margin and injury margin have been evaluated will be charged with the levy of anti-dumping duty.

for more details click here.