Global Wind Energy To Achieve 840 GW by 2022

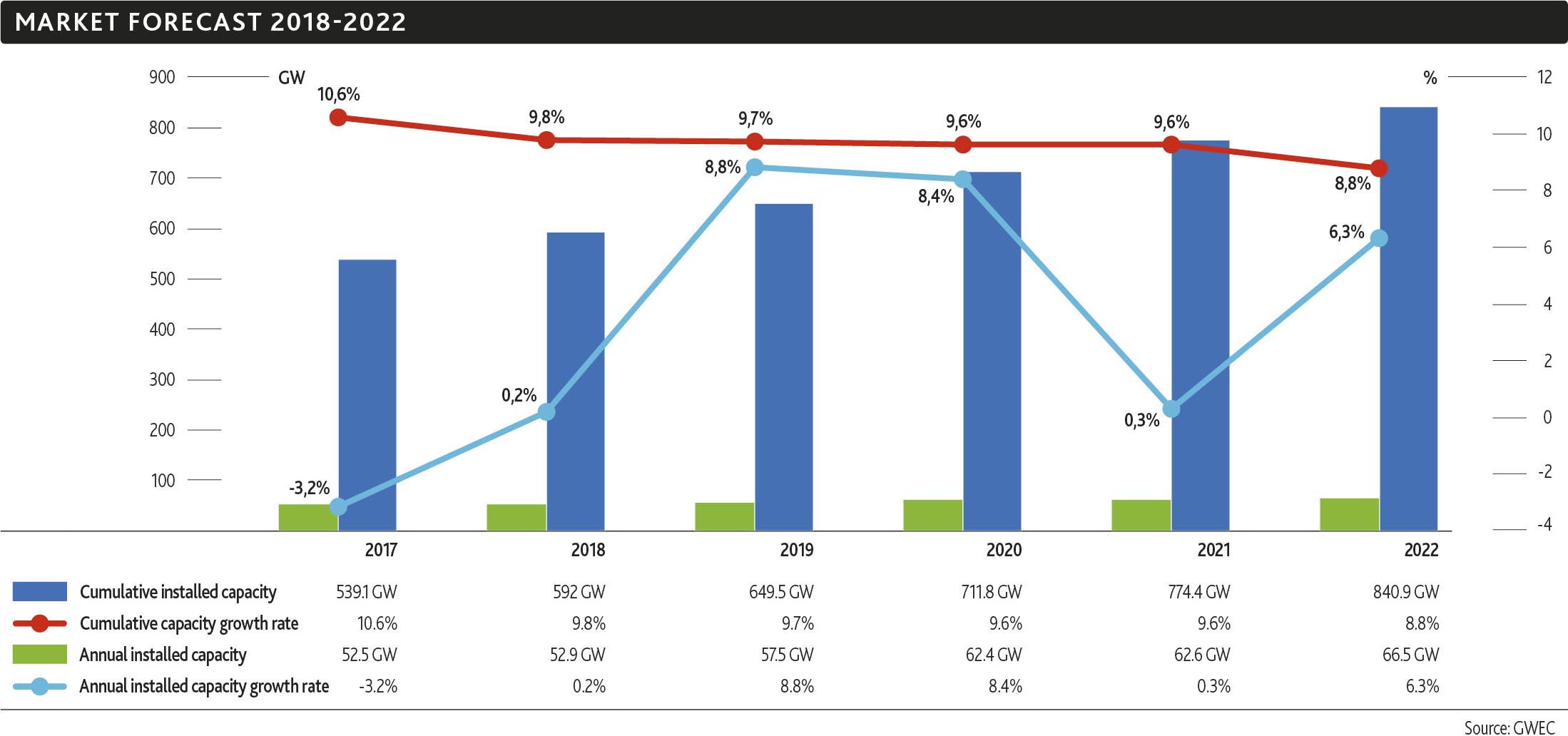

A report published on Wednesday by the Global Wind Energy Council (GWEC) titled “Annual Market Update 2017” predicts the Global Wind Energy Sector to expand to a figure of 840GW by the year 2022.

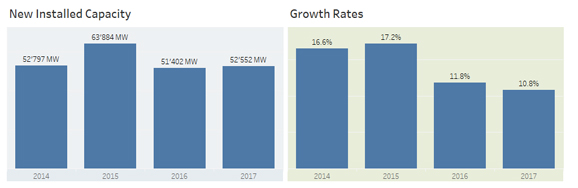

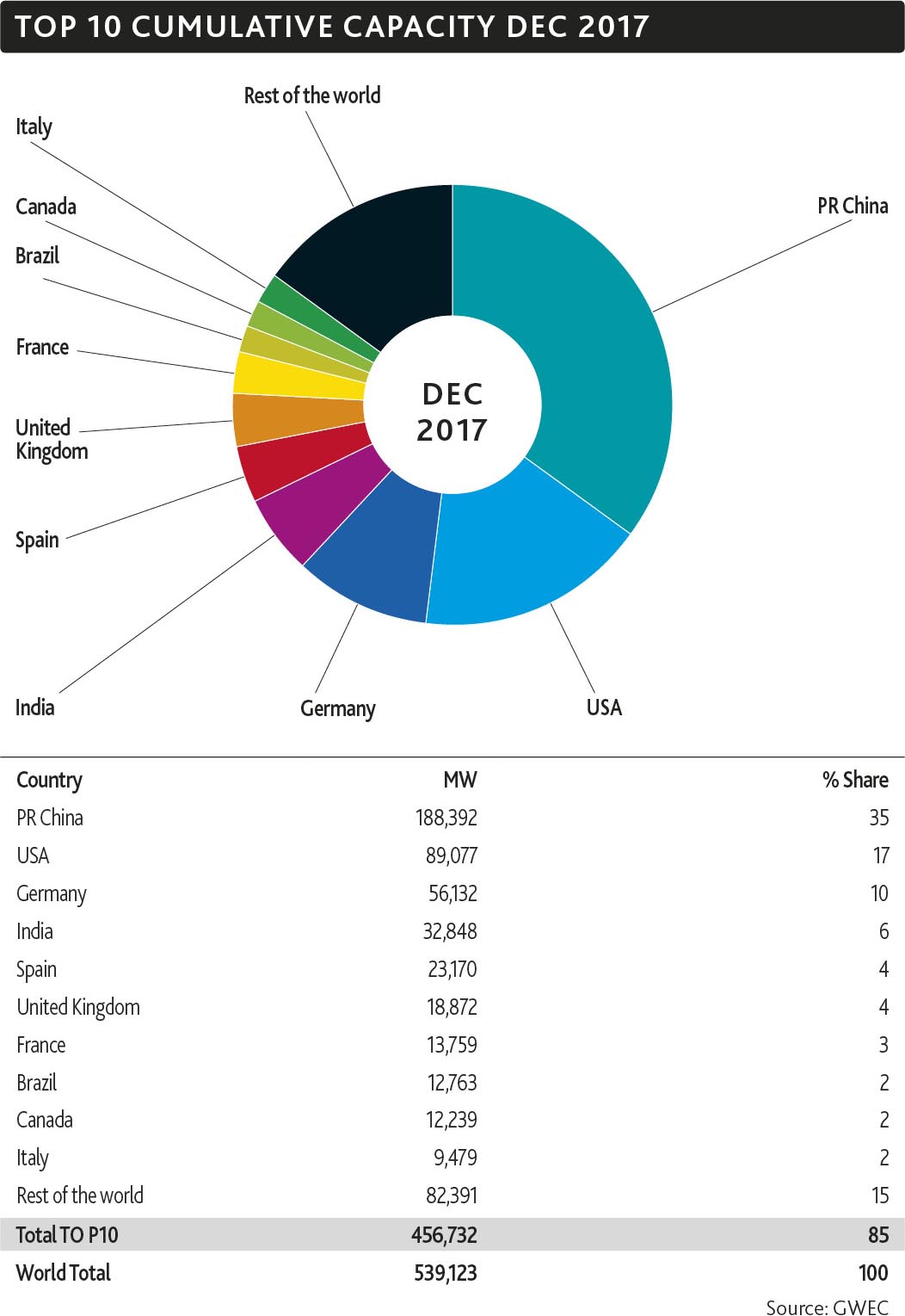

The world’s current overall capacity of installed wind energy lies at 539,291MW with a figure of 52GW added in 2017 making last year the third largest in terms of numbers installed in a year, falling behind 2015 and 2014 respectively. Even though 2017 was the lowest in terms of growth rate per year for the wind industry it was as a historic year for India, Europe and the off-shore sector.

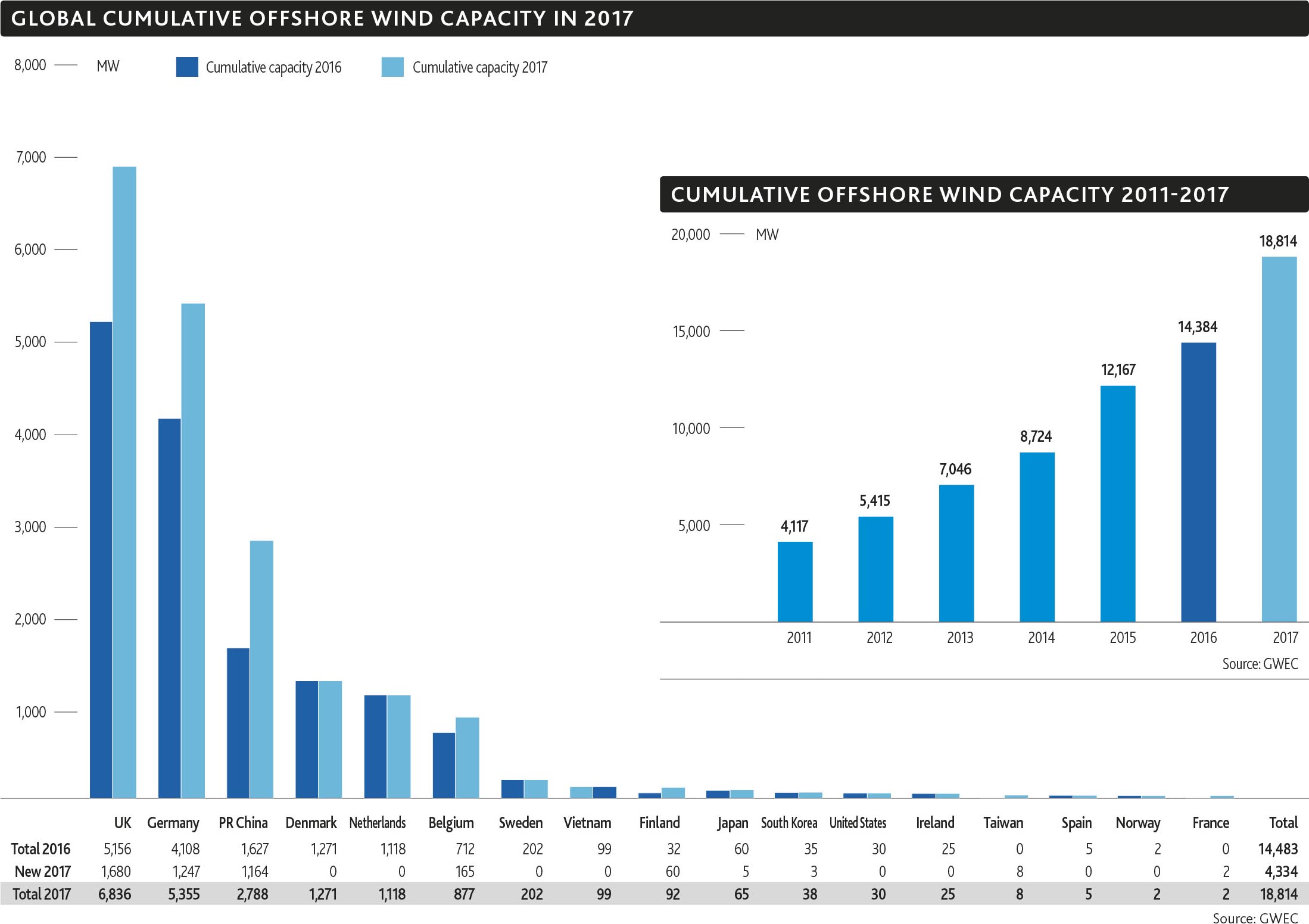

The off-shore segment had a record year with a global installation of 4334MW making a staggering 82% leap from the year 2016 in terms of market growth; bringing the total global capacity to a total of 18,814MW. Even though off-shore occupies a mere 8% of the global market it represents 3.5% of the cumulative installed capacity.

China, retained the top spot as the global leader in wind power capacity with its market reaching 188GW by the end of 2017. In terms of wind installation it again snagged the top spot adding 19.7GW to its capacity however this figure does point out a 16% drop in market compared to 2016. Nevertheless, with China’s current installation rate it might just meet its target for 210GW wind capacity by 2020 a year early. China, also had its first 1000MW+ off-shore market in 2017 which, is expected to grow in the next few years.

India had a record year in 2017, with the country breaking the “4GW in a single year” barrier for the first time in its history, thereby cementing its place as the second largest market in Asia, fifth globally in 2017 installations and fourth in global cumulative rankings. With a target of achieving 175GW from renewables by 2022, India plans to have a wind capacity of 60GW, with its current installation capacity at 32,848 MW, India would need to generate 7GW/year in order to reach its target.

Europe as a whole also set new records in 2017. 15.6 GW of new wind capacity was installed last year, with 3148MW of it being off-shore thereby doubling the off-shore capacity. The overall onshore installations increased by 14% with a total increase in market by 25% from 2016. The European market was led by Germany with 6581MW (19% of which was off-shore). United Kingdom was right behind their German counterparts with 4270MW, which was five times the amount in 2016 (1680MW of the total was off-shore). Finland, Ireland and Belgium also set records by installing 535MW, 467MW and 426MW each. It is however alarming that the number of countries with new installation in Europe dropped from 20 to 17 in 2017and 80% of the new installations were concentrated in just three countries. The new cumulative total for the European Union is 168.7 GW generating 11.6% of its electricity demand.

After the financial crisis of the previous decade, the wind market had a stagnant growth of 40GW per year from 2009-2013. It was in 2014 that the market broke the 50GW barrier, further pushing 2015 into the “60GW per year bracket” as a result of the enormous installations in China. 2016 and 2017 remained in the “new-normal” of 50GW and the report predicts the same for 2018 due to the anticipated decrease in Germany, UK and India. However, the market is predicted to grow and break the 60GW per year barrier once again in 2019 and 2020. This growth post 2019 is expected to go at a slower pace than what was seen at the beginning of the decade but is expectant to reach a cumulative installation of 840GW by the end of 2022.

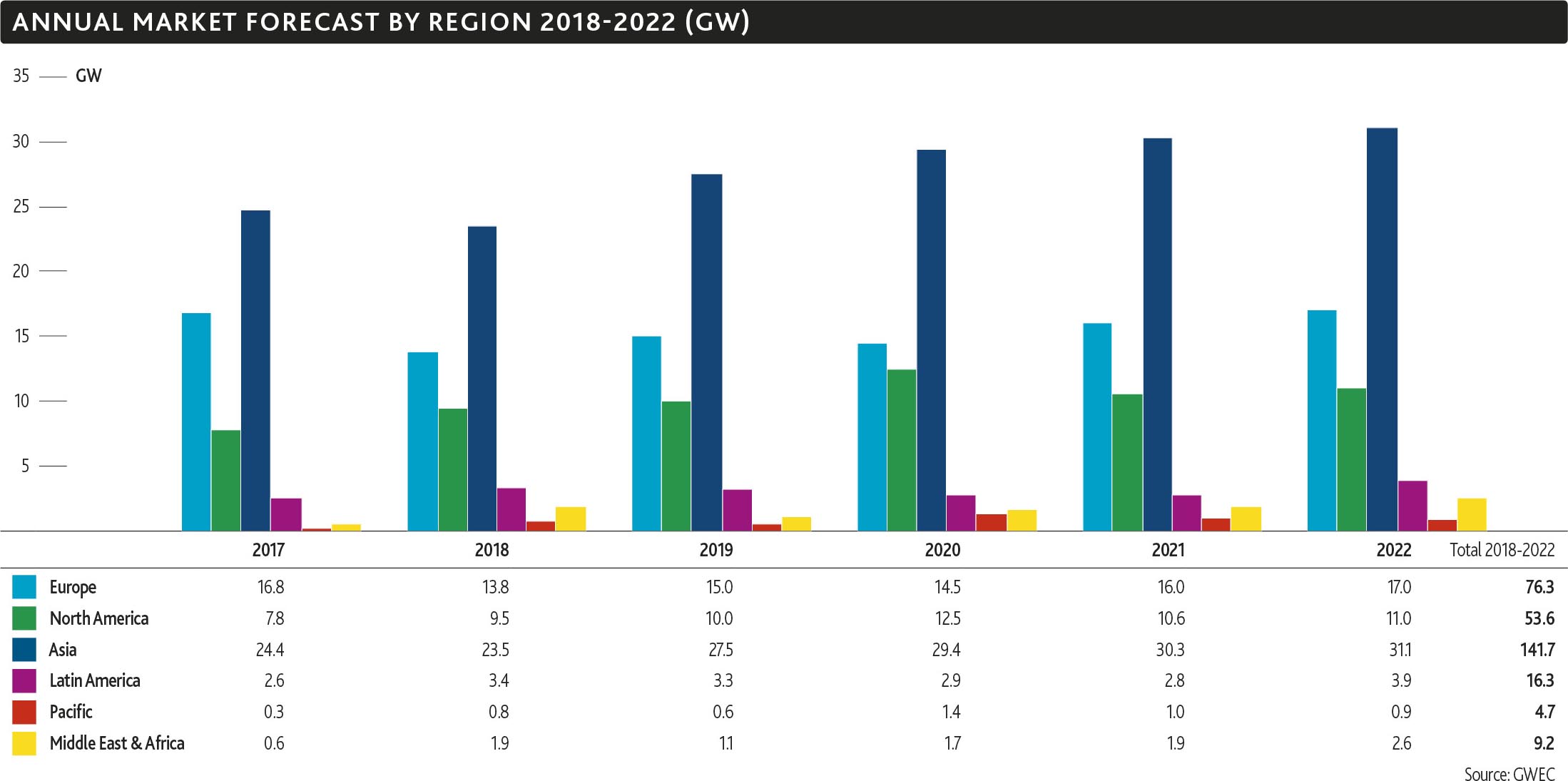

Asia is the current undisputed leader in installed capacity with its current capacity at 228.7GW. Its led by China but with India’s growth in the wind sector and emergence of new albeit smaller markets especially in Thailand, Philippines and Vietnam. Asia is set to remain as the global leader.

Europe comes in behind Asia in the regional cumulative market forecast. Despite reservations Europe did have a record year in 2017. Albeit, its two main contributors Germany and UK are unlikely to set any new records for this year due to changes in their policy landscape. Overall Europe is estimated to be in line with its 2020 target having a cumulative total of 254GW and with the EU raising the overall renewable target to 35% by 2030 it could push the European market in a much stronger position for the post 2020 market.

North America is set to be the third highest in terms of regional markets with USA leading the way. United States remained as the second largest in terms of installed capacity after China, with 7017MW added in 2017, it solidified wind as the country’s number one source of renewable power. With the stable policy environment, the main driver for wind installations is the 67% in price drops since 2009. The current total capacity of USA is at 89077MW.

As for Latin America the installations dropped for the second time in row from 3078MW in 2016 to 2578MW in 2017. Brazil is the current leader with 2022MW wind capacity, it makes up for more than three quarters of the capacity in that region. Brazil is estimated to dominate the market in the region, however with Argentina’s new installations due in 2018 it will be interesting to see how the market will play out in the future of Latin America.

2017 may not have been a great year for wind energy but in a comment stated in the report by Steve Sawyer (secretary general of GWEC) the improving economics of wind power, solar as well as storage outline a future of sustainable energy systems.

![]()