Global Energy Storage Market To Grow 13 Folds by 2024: Woodmac

The global storage market is expected to grow from 12 gigawatt-hours (GWh) to 158 GWh by 2024, according to a report by global research and consultancy group, Wood Mackenzie.

In its report, Global Energy Storage Outlook 2019: 2018 Year-in-Review and Outlook to 2024 which was released on Tuesday, the company added that energy storage has been creeping into decarbonizing markets over the past five years.

The report also added that energy storage would become a key technology in the electricity grid system and become a necessary technology to enhance system flexibility and enable clean, rapid system balancing, while “de-risking ever increasing intermittent assets and portfolios.” Incidentally, energy storage advances have ranked no. 1 in our own assessment of the top risks to coal fired power generation.

Commenting on the report, Ravi Manghani, Wood Mackenzie Power & Renewables research director, said that from 2013 to 2018, the company saw fledgling market growth, which was reflected in a global GWh compound annual growth rate (CAGR) of 74%, although it observed relatively small deployment totals of between 7 GW and 12 GWh for the period.

“Nevertheless, these developments have shifted the minds of global regulators, policymakers, grid operators, asset operators and developers, in terms of how energy systems can be balanced,” he said.

Grid-level storage will continue to dominate, alongside a strong residential market in which householders are expected to switch to long-duration grid ancillary services that could see storage replace diesel, gas and oil peaking power plants, especially in countries which import energy.

And solar will play a pivotal role, with the Wood Mackenzie report predicting the continued proliferation of solar plus storage generation projects out to 2024.

“Market structures have generally struggled to keep up with the pace of this technology, illustrated by the limited number of revenue streams available to appropriately compensate storage. More than half of the GWh during this period came online in 2018 alone, beckoning an inflection in storage demand,” he explained.

Still, 2018 was record-breaking year according to the report as it saw 140% year-on-year growth in GWh terms – with a total of 3.3 GW to 6GWh deployed globally. “The U.S. and China are projected to dominate the market, making up 54% of GWh deployed capacity by 2024. This will be driven by market reforms and state mandates,” the report showed. This is a shift from an earlier prediction in which U.S. was likely to regain its top position in 2019, with a projected 21 percent of global installations, followed by South Korea, China, Japan and Australia.

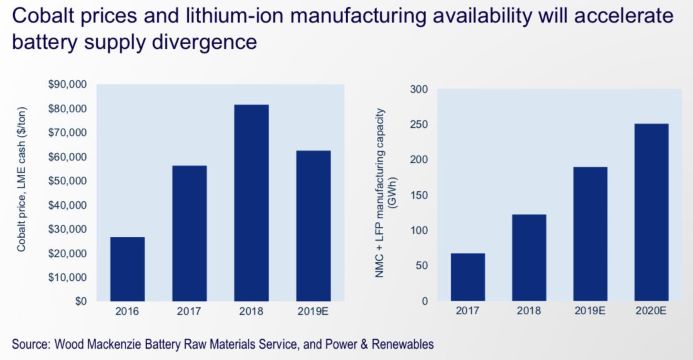

In December last year, Woodmac predicted that cobalt prices will decline over the next two years, as the price spike had focused its attention on lithium-ion chemistries that don’t require cobalt, such as lithium iron phosphate (LFP), lithium manganese oxide and lithium titanate. The company predicted that LFP, the most common of these chemistries, will retake its former place as the lithium-ion chemistry of choice for the energy storage industry in 2019.

Currently, between 2019 and 2024, Wood Mackenzie Power & Renewables expects major storage markets to flourish – with a more mature, but still early stage GWh CAGR of 38%,” the new report stated.

Picture credit Vanadium Corp