Investments in solar and wind (RE) energy projects by the world’s major oil majors until 2025 are expected to exceed USD 18 billion, a new analysis by Rystad Energy has found. However, a closer look at the numbers reveals that some USD 10 billion, or 55 percent of the amount, is expected to be invested by a single company – the Norwegian state-controlled energy giant, Equinor.

Based on the report it appears to be the only operator poised to direct a majority of its greenfield capex towards renewable energy projects. The energy giant will drive renewable investment among majors, spending USD 6.5 billion in the next three years to build its capital-intensive offshore wind portfolio.

“We do not expect this forecast to be heavily affected by the fluctuating oil price or capex cuts, as much of the company’s renewable portfolio is already committed, such as the massive 3.6 GW Dogger Bank offshore wind project under construction in the UK,” the report stated.

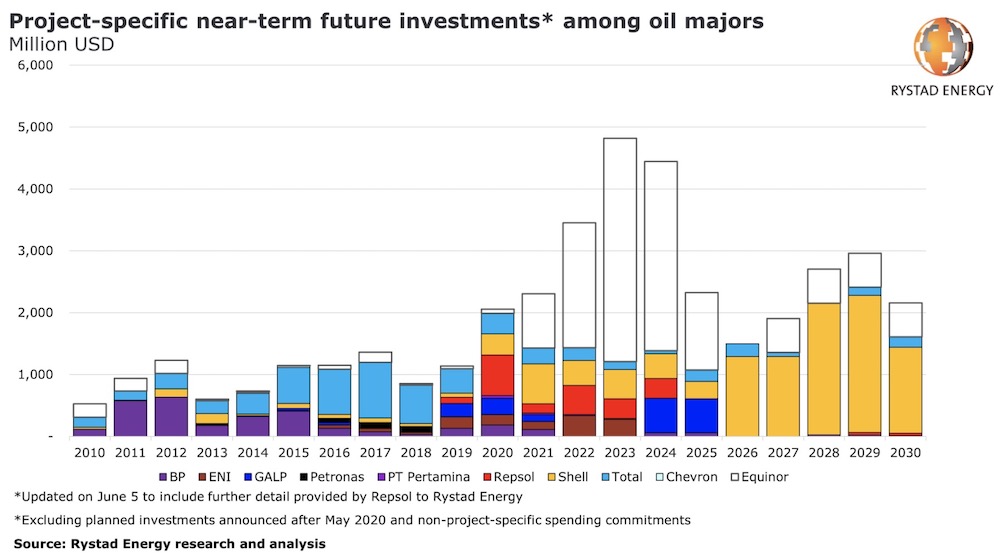

The analysis takes into account solar and wind investments that were announced prior to 1 June 2020 and that can be pinpointed to specific projects. Oil majors have pledged more funds to renewable energy targets than those listed in this outlook, but we have chosen with this analysis to exclude spending plans that are not project-specific, given the heightened uncertainty of those investments actually being made.

The report highlights that if Equinor is removed from the outlook, renewable investments from major oil and gas companies can be seen in a very different light, showing a decline over the next three years. And that this fall does not even factor in any of the recent capex cuts announced by the majors.

“Recent suggestions of ‘resilient green strategies’ or ‘business as usual’ simply do not carry much weight, with the exception of Equinor. Not until later in the decade do we see an increase in renewable spending from other companies,” said Rystad Energy’s Product Manager for Renewables Gero Farruggio.

After Equinor, the runner-ups are Portuguese operator GALP, directing just under a quarter of its greenfield expenditure to green initiatives, and Spanish operator Repsol, which has pledged EUR 600 million to three RE projects this year.

The analysis finds that almost all of the renewable investments by oil and gas players will come from only 10 oil majors, which are collectively poised to spend just over USD 18 billion on specific renewable energy projects through 2025. This tally, however, pales in comparison to the USD 166 billion they are forecast to spend on greenfield oil and gas projects during the same period.

With the notable exceptions of Equinor, GALP and Repsol, the investments in renewables by the other oil giants will not even match the typical capex requirements of a single oil and gas field in their respective portfolios.

The analysis states that if needed, due to the pandemic, a 20 percent capex cut across overall investment portfolios could be achieved while easily avoiding any cuts to renewable projects. GALP and Shell look the most exposed to potential renewable spending cuts, but these companies are not expected to make significant renewable investments in the near term – not before 2024 for GALP and even later for Shell – by which time it is expected that the oil price will have recovered, thus creating a better environment for investment.

But COVID-19 could also be the catalyst for oil majors to pump more capital into renewables, acquiring assets, developing skills and nurturing the capacity to transition beyond petroleum.

“The pandemic is creating a number of distressed sellers and reducing acquisition costs for assets and companies, thereby creating opportunities for Big Oil to accelerate its energy transition through acquisitions. And with E&P companies announcing deep spending cuts, we may yet see a ramp-up in renewable investments as recent headlines suggest, facilitated by new mergers and acquisitions,” added Farruggio.

Source: saurenergy.com

India is undergoing a significant influx of urban migration and a reclassification of rural areas,…

India’s quest toward green hydrogen economy received a significant boost with a strategic MoU between…

A new report by S&P Global has revealed that India’s growing biofuels industry is emerging…

In a significant breakthrough for India’s renewable energy and dairy sectors, dairy major Amul has…

Renewable energy conglomerate Anaergia Inc, through its subsidiary, Anaergia S.r.l., entered into a contract with…

Reliance Industries Ltd (RIL) Chairman Mukesh Ambani has announced a massive ₹75,000 crore investment in…