CEA to Look Into Discoms’ Mounting Dues to RE Firms

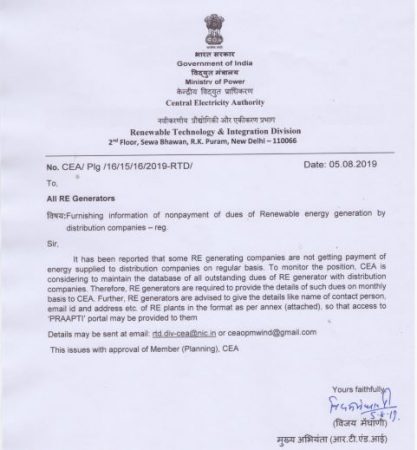

The central electricity agency CEA wants renewable energy companies to furnish details of their dues that distribution companies have failed to clear.

In a letter dated 5th of August the central agency raised the issue of non-payment by the discoms and said,” It has been reported that some renewable energy generating companies are not getting payment for energy supplied to distribution companies on a regular basis. To monitor the position, CEA wants to maintain a database of all outstanding dues of renewable energy generators from distribution companies.”

In May this year, MNRE had expressed the need for a web portal to publicly disclose payment delays to renewable energy players from power distribution companies (Discoms). The move is expected to bring in more transparency in pending payments.

The renewable energy sector has been demanding a portal similar to Payment Ratification and Analysis in Power procurement for bringing Transparency (PRAAPTI) portal be created for the RE sector to make the payment process transparent.

Dues as on date run into an estimated ₹ 60,000 crore, half of it being towards independent power producers in the power sector. More than 80 percent of the outstanding is accounted for by India’s most industrialized states such as Maharashtra and Tamil Nadu who are the biggest consumers of electricity. The top-10 states take an average of 562 days for payments.

Tamil Nadu, who has been one of the leading states in the country so far in setting up renewable energy assets, has halted RE auctions.

According to the Indian Renewable Energy Development Agency (IREDA), on an approximate basis, Tamil Nadu owes ₹1,100 crore each to wind and solar energy generators, as on April 1, 2019. While other green power majors, Karnataka owes ₹3,110 crore, Andhra Pradesh owes ₹2,800 crore, Maharashtra owes ₹2,460 crore to renewable energy firms. The overall dues to renewable energy firms stand at an estimated ₹13,820 crore.

Starting August 1st, as per the mandate of the center, the state-owned Discoms have started to offer letter of credit (LCs) for the power purchase as payment security. The Discoms are said to have been offering LCs for power purchases spanning from a week to a month in advance. These LCs will be invoked if the Discom defaults in payments to the power generation company (Genco) beyond the 45-day or 60-day grace period for clearing dues, as provided in the power purchase agreement (PPA).