BP Energy Outlook: Renewables Growing Fast But Oil Is Here To Stay

The UK-based oil company BP in its study report says that Renewable Energy sources will become the world’s main source of power within two decades and are establishing a foothold in the global energy system faster than any fuel in history.

The report elaborates that oil took almost 45 years to go from 1% of global energy to 10%, and gas took more than 50 years, however, renewables are expected to do so within 25 years in the report’s central scenario but there are challenges too.

“The emissions-reduction side of this dual challenge will mean shifting to a lower-carbon energy system, as the world seeks to move to a pathway consistent with meeting the climate goals outlined in the Paris Agreement. Much more progress and change is needed on a range of fronts if the world is to have any chance of moving on to such a pathway,” Bob Dudley, group chief executive, BP.

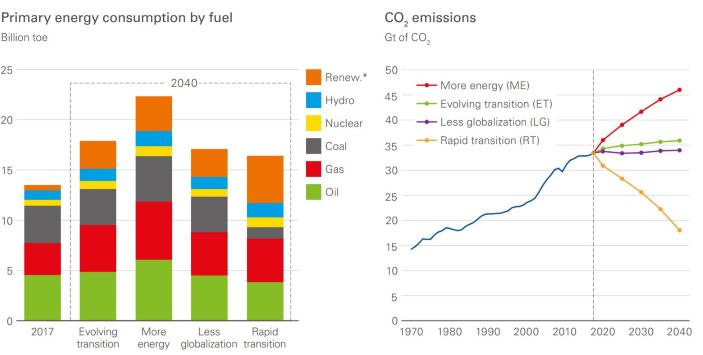

According to BP Energy Outlook 2019–wind, solar and other renewables will account for about 30% of the world’s electricity supplies by 2040, up from 25% in BP’s 2040 estimates last year, and about 10% today.

In the event of a faster switch to a low carbon economy, that period comes down to just 15 years. The company said it expected growth in renewables to be driven by government policies, technological change and the falling costs of wind and solar power.

Renewables are expected to grow by 7.1% each year over the next two decades, eventually displacing coal as the world’s top source of power by 2040.

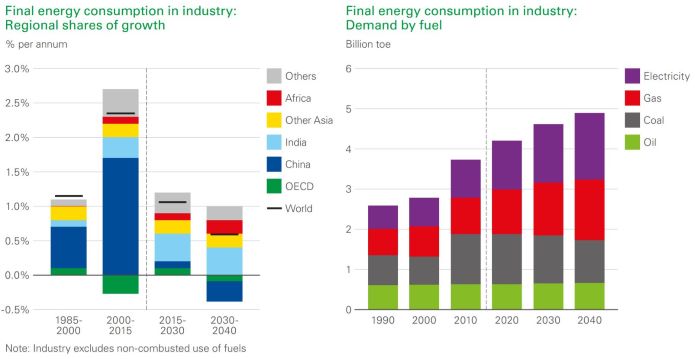

The group sees energy demand growth in China slowing as the country’s economy moves away from polluting industries to a more services-based one. That should lead India to overtake China for growth in energy by the mid-2020s. BP’s forecast for Chinese energy demand is down 7% on its outlook last year.

The impact of trade disputes, such as the ongoing one between the US and China, were also examined in the report. The oil company sees energy demand 4% lower in the next two decades if such disputes continue, as a result of lower global GDP and trade flows. Coal consumption within industry is projected to decline as China, the EU and North America switch to cleaner, lower-carbon fuels, partially offset by growth in India and Other Asia.

On the other hand, the company does not see oil going away any time soon. The outlook’s core scenario envisages that oil demand does not peak until the 2030s, though under its greener scenario that milestone could be reached between now and the early 2020s.

Regardless, BP sees a “major role” for hydrocarbons until 2040, which it says will require substantial investment. It expects global demand for oil and gas to be 80-130 million barrels per day by then, up from around 100mb/d today.

To access the BP Energy Outlook 2019, click here.