A Power Shortage in California Throws up Enticing Possibilities On A Future of Renewables

More Renewables In The Air

More Renewables In The Air

For Countries like India, which are still hamstrung by capital, costs or a thermal legacy in their push to adopt renewables as fast they should, the state of California continues to provide an ongoing lesson . Be it mandating a target to decarbonise its energy sector by 2050, or the selective subsidies on both solar and now, storage that the state is using to combat its challenges, the state will be watched by a lot of people in the coming 18 months. In fact, from January 1, arguably the biggest and most visible move by the state to turn decisively towards renewable energy will kick in, the mandate to have every new house that comes up, equipped with solar power. As the most economically powerful state in the US, what California does today, matters, as the rest of the country follows suit. That explains the new hopes from the state regulator’s plans to procure an extra 3.3 GW of power from all sources.

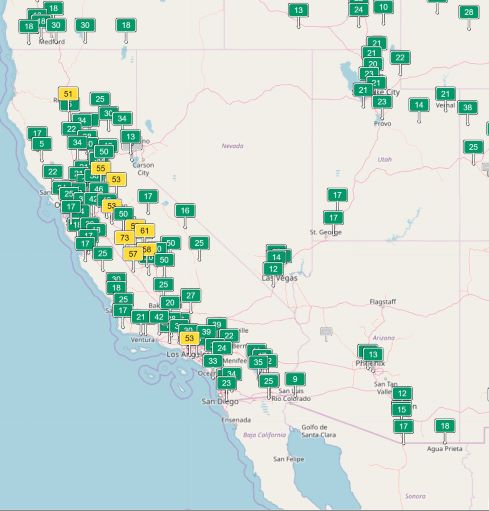

The forecast from state grid operator CAISO, blames a combination of nuclear power plant closures, uncertainty over the value of natural gas plants, besides solar power and electricity imports from other states in the coming years fo the shortfall, expected to peak by 2022. Power utility Southern California Edison, has projected an even deeper shortfall — as much as 5.5 gigawatts by 2023, including the retirement of OTC capacity. That should be taken seriously, as the utility serves the regions mostat risk from these shortfalls.

The new projection is significantly higher than CPUC’s September proposal, when it projected a 2.5-gigawatt procurement, centered on utility Southern California Edison and CCAs (Community Choice Aggregator) in its territory.

Now, the CPUC expects the CCAs and DA (Direct Access ) providers across the state to procure the new demand, based on their existing share of load. Each will need to procure half of their total by 2021, 75 percent of it by 2022, and all of it by 2023.

Though hypothetically open to natural gas fired plants also, widely being pushed as a bridge between ‘dirty’ fossil fuels and truly renewable energy, industry observers hope that a large chunk of this new procurement will fall with renewable suppliers.

The move by the California Public Utilities Commission sets the stage for every utility, CCA and third-party DA provider to make their pitch for a share of the new buys. CCAs across the state will be responsible for roughly one-quarter of the 3.3-gigawatt procurement.

Among those expected to make a big pitch are solar plants paired with batteries for storage to to shift its daytime output to late afternoon and early evening,( when demand peaks), and demand response systems that can nudge energy consumption away from those high demand periods. Earlier this week, CalCCA announced that its members have contracted for nearly 3.2 gigawatts of renewable power purchase agreements, mostly utility-scale solar. Energy storage is also gaining favour fast, with 239.5 megawatts/788 megawatt-hours of energy storage contracts signed till date.

86 percent of this 239 MW is co-located with solar .

California residents, by accepting some of the highest power prices in the United States, as the price for the state’s green drive, have done their bit in providing valuable learnings, and an early market for a number of newer technologies, and scale for technologies looking for it. That has meant a higher possibility of the rice curve moving down, a possibility that will do much to accelerate the energy transition.