EY – SED Fund report, “Accelerating Green Hydrogen Economy”, released at the CII’s conference “Green New Energy for a Net Zero India” in Bengaluru made a strong case for the best pathway to execute for India.

The report highlights that India’s ambition to produce 5 million tons of green hydrogen by 2030 will need ~115 GW of renewable power generation capacity and ~50 billion litres of demineralized water supply. To get a sense of this scale, the current all-India installed capacity of renewable power generation is ~113 GW as of May 2022. The country has a target of 500 GW by 2030.

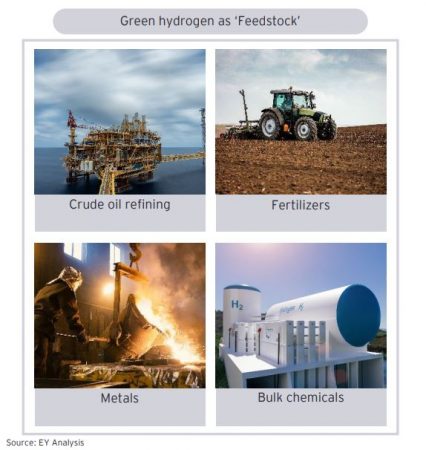

Somesh Kumar, Partner and National Leader, Power & Utilities, EY India, said, “ The emergence of green hydrogen as a promising low carbon feedstock and energy carrier for industrial applications is a boon for India’s long-term energy security, sustainability and self-reliance.”

Further, the report states that the levelized cost of green hydrogen production and storage (LCOH) is currently ~ INR 400/kg. 40-50% of this cost can be attributed to the renewable energy power plant, 30-40% for electrolyzer stack and balance of system including demineralized water supply and 20-30% for compressed storage.

Sivaram Krishnamoorthy, Deputy Director, SED Fund, said, “The race to decarbonise energy intensive industries depends on the competitiveness of green hydrogen supply chain and enabling policy ecosystem to make this happen. State governments have a key role to play in implementing recently notified green hydrogen policy and green energy open access rules 2022 to support the industry in reducing the cost of production”

The EY – SED Fund report recommends key sub-national policy interventions to accelerate the green hydrogen economy:

The report further identifies ~41 shovel-ready projects in the green hydrogen supply chain, out of which 31 are commercial projects and 10 are R&D projects funded by the Department of Science & Technology (GoI). The project’s database comprises green hydrogen production, electrolyzer manufacturing, hydrogen retail and R&D projects. These projects are under permitting or announced stage for the year 2021 till May 2022. In the year 2022, only 7 projects are announced as compared to ~24 commercial projects in the year 2021. The green hydrogen production pipeline project plans to install ~7.77 GW electrolyzer plants, while the cumulative electrolyzer manufacturing project capacity stands as ~4 GW/year.

The EY-SED Fund report also highlights multiple factors that drive the techno-economics of the green hydrogen supply chain:

Note: All visuals and pictures courtesy EY-SED Fund Report

In a significant move toward advancing green energy and industrial growth in the state, Himachal…

Golabl chemical conglomerate BASF has announced that its now offering the world’s first biomass-balanced polyethersulfone…

In a crucial stint to bolster the biogas sector and sustainable dairying in the country,…

TotalEnergies SE has received approval to proceed with its Middlebrook solar and battery project in…

Andhra Pradesh Chief Minister Chandrababu Naidu has inaugurated the Rs 1,000-crore green hydrogen plant of…

The BITS Pilani has developed an innovative solution for managing landfill leachate, domestic septage, and…