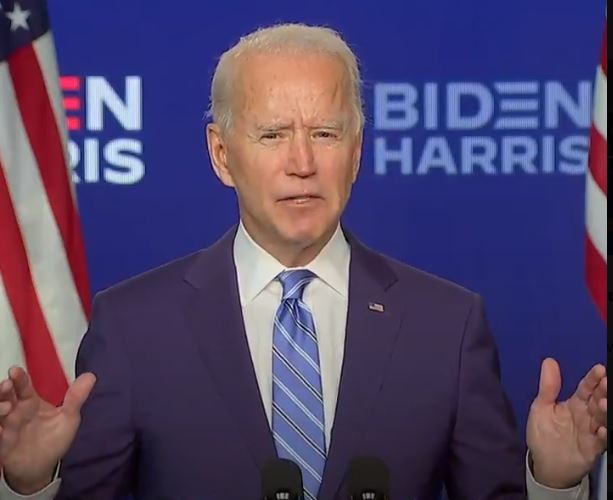

The Joe Biden Impact on Climate Change

Nothing the new Joe Biden administration can do will beat the symbolism of the US rejoining the Paris Accord. Less than 80 days after the effective withdrawal date of November 5. The announcement , and the process to withdraw was initiated by President Trump on June 1, 2017. By rejoining the Paris accord, even though it has non-binding commitments, the US will signal a willingness to shoulder its share of the effort required to limit global warming to 2 degrees or lower. Importantly, the heft the US brings will also push more countries towards goals that are as ambitious, if not more than the commitments made in 2010. Thanks to a drop in renewable energy prices, especially solar, that have been well below projections for the 200-2020 period, we have already seen many countries, and industry even commit to fresh, more ambitions targets. And energy is the pivot around which the whole climate movement will progress.

A second big area to benefit will be the push for decarbonisation of transportation. While this progressed satisfactorily, despite the Trump administration’s indifference, thanks to strides in China and parts of Europe, we can expect a major push here too. US states that push for tougher emissions norms will no longer face the sort of pushback from the federal government that they did earlier. That could nudge auto firms to ramp up roadmaps to a EV future even further. A drop in battery storage costs, as predicted by Tesla, will have an impact well beyond transportation, in fact.

One of the most visible failures of the Trump administration was its inability to save coal, or jobs linked to coal mining in the US. Once again, that was linked more to a profound shift in market economics and sentiment, than any policy move. The drop in renewable energy prices has meant that utilities increasingly look beyond coal for their future energy requirements. Coal based energy has been under unprecedented attack in the developed world, with both mining, generation and financing for fresh plants under serious assault. A Joe Biden administration will do nothing to change this. More importantly, even as it avoids any hard calls on fossil fuels, especially crude oil and gas, chances are, it will leave those too to face market dynamics now. Already, the Covid pandemic has laid low petroleum demand for 2020 and beyond. Analysts don’t expect peak demand to come back until 2024, or even never, if other changes like EV growth takes off. Fresh exploration for oil in hitherto protected areas that the Trump administration tried to encourage, might not happen. Shale gas exploration too, might not spread as much as the Trump administration wanted. Of course, with oil, a lot also depends on the price of oil. A sustained period of high prices could still derail plans to keep more oil and gas under the ground, as many environmentalists hope.

And then we have the much promised green deal. While the full green deal may not happen, considering the narrow margins for the incoming Biden administration in both the US senate and House, one can certainly hope to see a matching shift towards green hydrogen. Thee is no way the US will consider being left behind in an area where Europe, Japan, China and other countries are investing so heavily in. US based oil firms, which had been much more conservative in announcing plans unlike their European counterparts, can safely be expected to start the investment shift, as early as next year onwards now.

A quite beneficiary will be wind energy, especially offshore wind. The US has been a relative latecomer to the party for offshore wind, but expect that to change big time now. The Trump administration had slowed the process of approving offshore wind and proposed to close off a section of the US Atlantic coast from Florida to Virginia. A Biden administration will act faster to support states and companies seeking to develop offshore wind industries. A largr US market for offshore wind will have potentially wider impact in terms of a faster drop in prices, for instance, making it viable in markets like India, where cost has been a big drag for offshore wind.

For countries like India, it might look all good, but things could change quite quickly. For one, if extreme climate events actually accelerate indisputably, then the country will face global pressure, led by the US now, to accelerate its own energy transition. 2050 may become the global cut off for net zero energy emissions in a few years, that is sought to be made non negotiable. Something India simply cannot do without more active support in terms of technology transfer and funding from the rich countries. Hot button issues like water conservation, and more importantly, river water sharing across countries could rear up soon, bringing not always welcome US intervention in its wake. Keep in mind that India already has some serious issues building up literallly, due to Chinese build up of structures on the river Brahmaputra, and India’s own plans to use its share of the Indus river, that flows into Pakistan.