Sales of Energy Efficient Appliances Hit Due to Cost in India

More stars more money

More stars more money

More and more Indians are avoiding purchase of high energy efficiency rated white goods like refrigerators and air conditioners after the revision of the standards for household appliances last January. The revision which pushed up the prices of these consumer goods by about 20-30% has made the cost-conscious Indian consumer wary.

The sales data collated from an industry body, Consumer Electronics and Appliances Manufacturers Association (CEAMA) shows that the sales of 4star and 5 Star ACs have dropped by as much as half in the last 15 months compared to the period before 2018 January. The crash corresponds to the revision which pushed up the energy norms by two levels in January 2018.

On the other hand, SMCGs like the refrigerators, sales of 4-5 star rated models started to decline after 2015 when a revision was made. Subsequent tightening of norms in 2017 forced manufacturers to exit the five-star segment completely since last year due to no demand.

“The rating has done a lot of good to consumers and helped in the conservation of energy. But as the energy norms are tightened, they push up manufacturing costs and prices, whereby sales of higher-energy-efficient products are not realized to their full potential,” said CEAMA president and Godrej Appliances business head Kamal Nandi.

The price difference between 3-star and 5-star AC models has doubled from Rs 4,000-5,000 to Rs 8,000-10,000, which is driving the shift.

As per industry data, 81% of AC sales are now for three-star energy rated models, compared with 58% two years ago. Sales of this category have been expanding at 18%. By contrast, the five-star model’s contribution to total sales has dropped from 20% to 12% in the same period, with sales declining by 24%.

For refrigerators, four-star models were 45% of sales and 5-star was 23% in 2016. These came down to 22% and nil, respectively, last year.

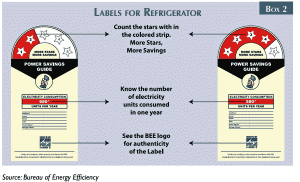

Three-star refrigerators now account for 46% of sales while 2-star models, which did not exist two years ago, now make up 26%. The power ministry-led Bureau of Energy Efficiency (BEE), which formulates rating norms for household appliances in India, plans to continue tightening energy norms to set global benchmarks as appliances such as ACs are power guzzlers, said director general of BEE, Abhay Bakre.

“The rating change is done through a scientific and consultative process that will benefit consumers and create healthy competition to develop better products. Once the market is transformed to higher energy-efficient models, the sales volume will lead to a reduction in their prices,” Bakre said.

But the problem remains as the latest revision of Indian norms are ‘more stringent’ than US, Europe, China. This means that consumer durable manufacturers may not have an affordable product with these specifications, which are prone to further tightening. And the newer versions, which may take time for development, will be costly. The growth of these appliances is driven by the middle class where affordability is a concern. Therefore, there is a need for discussion between the government and the manufacturers to reach a consensus to link energy rating changes and tax breaks so that both can achieve their targets in due course.