The global waste-to-energy market was valued at US$25.7 Bn in 2020 and is anticipated to be worth US$36.2 Bn in 2025, registering a CAGR of 7.1% during the forecast period, finds UK-based market research provider Fairfield Market Research.

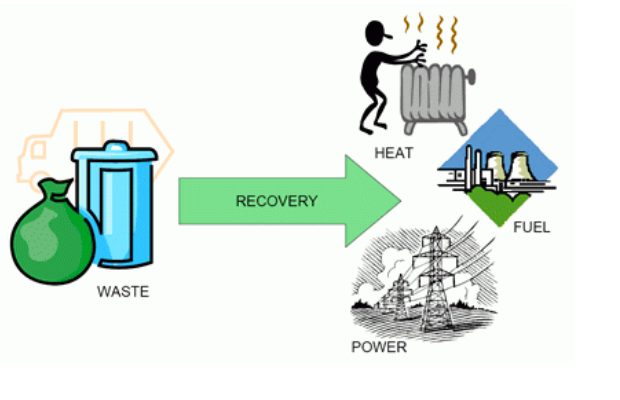

Waste-to-energy is a compelling method of energy generation to overcome the inevitable depletion of oil and gas reserves. The World Bank states that waste generation will double by 2025 to reach six million tons daily. Several countries are assessing alternate sources of energy because of environmental concerns, volatility in crude prices, and restricted landfills. Waste-to-energy solves long-term challenges by reducing the volume and decreasing the amount of greenhouse gas emissions, fuelling growth in the waste-to-energy market.

Need for Cities to Dispose of Waste Effectively Aiding Growth in Waste-to-Energy Market

The Paris Agreement, concerns about the safe disposal of waste, and ever-increasing investments in green energy are the primary drivers in the waste-to-energy market. Government subsidies help in no small measure. A lower scope for landfill coupled with greater waste generation has improved growth prospects in the waste-to-energy market. As the global population simultaneously grows and urbanises, waste is concentrated in metropolitan areas, putting the spotlight on efficient waste management frameworks. Cities are considering waste-to-energy units to cope with urban waste effectively, boding well for companies in the waste-to-energy market.

Thermal Conversion Only Cost-effective Option at Present in the Waste-to-energy Market

In 2020, the thermal technology segment held 51.6% of the waste-to-energy market with a value of US$19.9 Bn. Incineration is a popular process as it can reduce waste weight and volume by 75% and 90% respectively. The bottom layer of ash generated in incineration plants is used by construction companies, further reducing landfill burden. Incineration is the only waste-to-energy technology that is operationally feasible and viable on a commercial level. Heat recovered from incineration can be further deployed for hydroelectric power generation, making it well-worth the while for stakeholders in the waste-to-energy market.

Government Push to Use Biofuels Explains Europe’s Lead in the Waste-to-energy Market

In 2021, Europe accounts for the maximum share of the waste-to-energy market as a result of giants such as EQT, Suez Environment, Ramboll Group, and Veolia having their headquarters there. Supportive government policies including direct subsidies, carbon tax, and landfill tax are predicted to drive the waste-to-energy market over the forecast period. European energy and climate policy is emphasizing the need to move away from polluting fossil fuels, creating an incentive for waste-to-energy techniques to produce biofuels and biogas. Report predicts that the Europe waste-to-energy market will show a CAGR of 6.80% between 2020 and 2025.

China and India Unveil Grand Plans to Harness the Potential in the Waste-to-energy Market

Asia Pacific follows Europe in the waste-to-energy market with Australia, China, Japan, and South Korea particularly profitable. The Indian Ministry of New and Renewable Energy has unveiled an initiative to subsidise $310 thousand per MW up to a limit of $1.55 million per venture for five waste-to-energy plants. China has similar ambitions with its 13th Five-Year Plan that sought to generate 600,000 tonnes of energy from waste by 2020. This would necessitate the building of 200 new facilities between 2020 and 2030, benefiting demand in the Asia Pacific waste-to-energy market.

Key Players Entering Into Partnerships With Local Companies in Waste-to-energy Market

Some companies profiled in the report on the waste-to-energy market are Viridor, Ramboll Group, GCL Poly, China Everbright International Limited, EDF, AVR, EQT AB, Covanta Energy Corporation, Hitachi Zosen Inova AG, Babcock & Wilcox Vφlund A/S, Veolia, Seuz Environment, and Wheelabrator.

In 2019, Covanta Holding Corp. signed a concession agreement with Zhao County, China to manufacture and operate a waste-to-energy facility. The project is a joint venture between Covanta and a local partner. China’s energy-to-waste targets are aided by preferential tariffs on purchasing electricity from energy-to-waste facilities and it remains to be seen how rivals respond to this development in the waste-to-energy market.

As Kerala strives towards a sustainable future, the Kochi Water Metro Limited (KWML) has revealed…

Kundan Green Energy has acquired Jabalpur MSW Pvt. Ltd., a well-established Waste-to-Energy plant that was…

Agriculture waste to energy conglomerate SAEL is preparing to go public within the next 12…

The Cuttack Municipal Corporation (CMC) and Oil India Limited (OIL) have come together to develop…

India’s Ethanol Blended Petrol (EBP) Programme has emerged as a global benchmark in clean energy…

Refex Renewables & Infrastructure Ltd. has announced that its wholly-owned subsidiary, Refex Green Power, has…