China To Smash Hydrogen Targets, Leads Electrolyser Market

- The nation is committed to using hydrogen for decarbonization, with Rystad Energy projecting the installation of approximately 2.5 gigawatts (GW) of hydrogen electrolyzer.

Jakson Green Wins NTPC Bid to Spearhead the World’s First Flue Gas CO2 to 4G Ethanol Project

Jakson Green Wins NTPC Bid to Spearhead the World’s First Flue Gas CO2 to 4G Ethanol Project

China’s national plan identifies hydrogen as a key element in its low-carbon energy transition strategy. The nation is committed to using hydrogen for decarbonization, with Rystad Energy projecting the installation of approximately 2.5 gigawatts (GW) of hydrogen electrolyzer capacity by the end of the year. This capacity is expected to produce 220,000 tonnes per annum (tpa) of green hydrogen, 6-kilotonnes-per-annum (ktpa) more than the rest of the world combined. Under its national plan, China is targeting green hydrogen production of 200,000 tpa by the end of 2025, but our analysis shows it will exceed that volume by the end of this year.

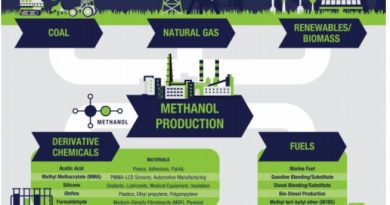

Mainland China installed a cumulative 1 GW of electrolyzer capacity in 2023, cementing its position as a world leader in the technology’s adoption. However, a substantial portion of China’s hydrogen supply is derived from grey hydrogen, produced through coal gasification or steam methane reforming (SMR). If China intends to achieve its dual carbon objectives of peaking emissions by 2030 and achieving carbon neutrality by 2060, switching to low-carbon hydrogen production methods will be crucial.

In early 2022, China’s National Development and Reform Commission released its national hydrogen plan, known as the ‘Medium and Long-Term Strategy for the Development of the Hydrogen Energy Industry’. This plan acts as a comprehensive roadmap for the county’s hydrogen goals from 2021 to 2035, with its production targets currently being met with relative ease.

“While China’s proposed standards and solutions represent progress, they currently fall short of the more stringent benchmarks set by European counterparts. The ambiguity surrounding the definitions of ‘low carbon’ and ‘renewable’ hydrogen within China’s policies is a notable concern. To truly catalyze meaningful change, it is imperative for China to adopt clear and stringent definitions that align with global best practices, such as those seen in Europe. By establishing unequivocal standards, China can ensure that its hydrogen initiatives contribute significantly towards a sustainable future, not just domestically but also on a global scale,” says Minh Khoi Le, head of hydrogen research, Rystad Energy.

Despite progress, a geographical disparity exists between China’s hydrogen demand centers in the east and its abundant solar and wind energy resources in the north, which are ripe for developing green hydrogen production. For example, Inner Mongolia and Gansu have set ambitious targets for renewable hydrogen production by 2025. Their efforts for hydrogen production, combined with other provinces, would collectively surpass 1 million tpa, a five-fold increase compared to China’s national target. However, this has resulted in a supply-demand mismatch, prompting China to explore the expansion of its network of hydrogen pipelines.

One notable endeavor is the development of a 400-kilometer pipeline by Chinese state-owned oil and gas company Sinopec, connecting Ulanqab in Inner Mongolia to Yanshan in Beijing. With initial capacity of 100,000 tpa, and plans to scale up to 500,000 tpa, this pipeline marks China’s first long-distance hydrogen conduit. Additionally, a 737-kilometer hydrogen pipeline from Zhangjiakou to the port of Caofeidian via Chengde and Tangshan is being developed by Tangshan Haitai New Energy Technology in Hebei, costing $845 million. If realized, it would be the world’s longest hydrogen pipeline. China Petroleum Pipeline Engineering Corporation, a Sinopec subsidiary, aims to expand this network to 6,000 kilometers (KM) by 2050.

China has significant solar and wind power potential in its north and northwest regions, including Xinjiang, Gansu and Inner Mongolia. The nation’s solar PV capacity surged to 217 GW of new installations in 2023, 2.5 times the amount installed in 2022. For wind installations, 76 GW was added in 2023, double that of 2022. Most new wind installations were in Inner Mongolia, with more than 24 GW of new capacity, and Xinjiang and Gansu, each with over 5 GW of new capacity. As such, it is unsurprising to see most green hydrogen projects being announced in these regions which offer abundant renewable capacity.

Provinces with strong solar and wind potential have also announced more ambitious hydrogen production targets. For instance, Inner Mongolia aims for 480,000 tpa of renewable hydrogen production by 2025, while Gansu has set a target of 200,000 tpa. These provinces are heavyweights for transformation in the region, significantly affecting the 1 million target mentioned earlier and contributing enormously to China’s hydrogen production in the region.