The global credit rating agency, Moody’s Investor Service recently released its latest report, “Power Asia – Climate goals, declining costs of renewables signal decreasing reliance on coal power”. The report revealed that the share of generation capacity from non-fossil-based fuel sources in India will likely increase to 45 percent by 2022 as India plans to increase its renewable energy capacity, excluding hydro, to 175 GW and that both wind and solar have already achieved grid parity.

“This is higher than India’s commitment under the 2015 United Nations Climate Change Conference (UNFCCC) in Paris (the Paris Agreement) to have 40 percent of the country’s total generation capacity from non-fossil-based fuel sources by 2030,” the agency said in its report.

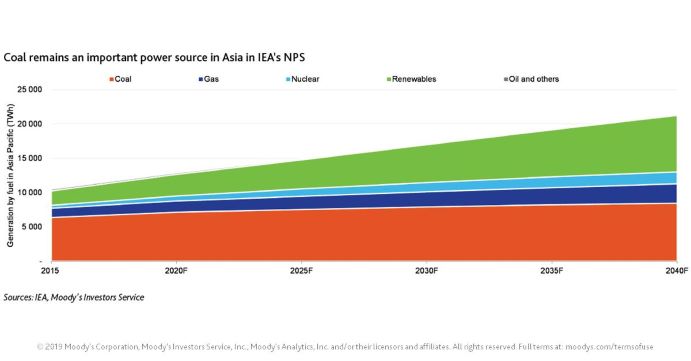

The report stated that coal power will remain important, but the possibility that it will become uneconomic is rising. “In our baseline scenario, renewable power will not grow fast enough to meet Asia’s total power needs on its own. But the share of coal power in Asia’s power mix is declining with governments’ climate change and air quality goals. And coal-fired generators could become uneconomic sooner than in our baseline scenario, given governments’ clean energy policies, the declining costs of renewables and ongoing technological advances,” it said.

[related_post]

This matched the findings released by the International Energy Agency’s New Policies Scenario, which predicted that the share of coal in the country’s power mix in the NPS decreases to 57 percent in 2030 from around 74 percent in 2017.

Also, the declining costs of renewable power will expedite transition toward renewables, according to Moody’s analysis. The declining costs for solar and wind will lead to increased renewable capacity and generation even without policy incentives. Coal power will face increasing challenges from renewables, particularly if costs for battery storage decline significantly and storage efficiency increases. Both the factors would increase the reliability and stability of power supplied from solar and wind.

“However, the potential that coal power plants will become impaired or otherwise non-productive is rising given government policies promoting renewables, ongoing cost reductions for renewables and development of disruptive technology. More aggressive penetration of reliable renewable energy will clearly have a significant detrimental effect on coal power generators in the absence of compensation for declining dispatch volumes,” Moody’s said.

The report also added that the funding options for coal power are seen declining and this will further limit the growth of coal power in Asia. The tightening environmental regulations and improving economics for renewables will likely weaken investors’ risk appetite for new coal power projects with long tenors given the increasing long-term risk of holding and operating coal power plants. Investors and banks are also under increasing pressure to decarbonize their portfolios and reflect climate risk into those portfolios.

1. The mandate for blending Compressed Biogas (CBG) with natural gas has come into effect…

Andhra Pradesh is striving towards greening its energy sector with quite some speed. In a…

With an objective to bolster India’s green energy goals, a Tripartite Agreement has been signed…

The Union MNRE Minister Pralhad Joshi launched the Green Hydrogen Certification Scheme of India (GHCI)…

India’s energy conglomerate Bharat Petroleum Corporation Limited (BPCL) has commissioned a 5MW green hydrogen plant…

In a historical development, the European Space Agency (ESA) has successfully launched its pioneering ‘Biomass’…