The Corporate Buyer Market for Renewables. Tough choices all round

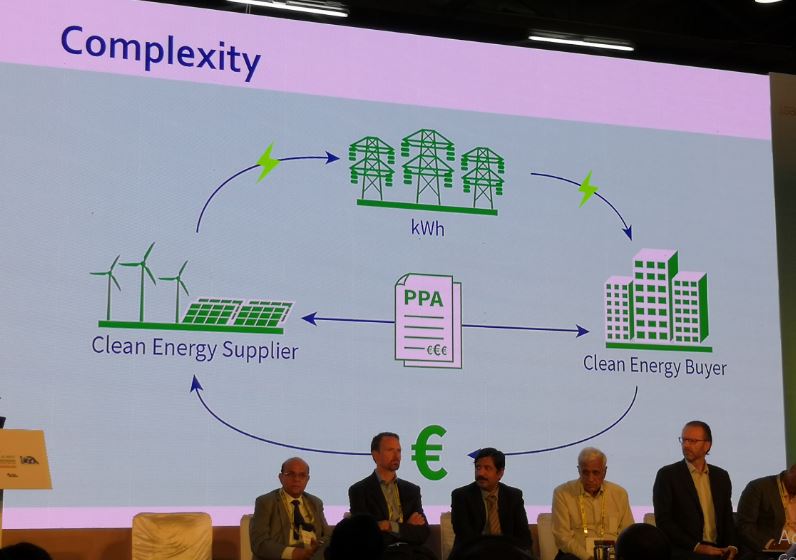

More complex than it looks

More complex than it looks

According to a report by the International Renewable Energy Agency (IRENA), in 2017, corporates in 75 countries actively sourced 465 terawatt hours (TWh) of renewable energy in 2017, a figure close to the annual electricity demand of France. For India, the scenario is decidedly less dynamic, with most of the action limited to Karnataka, the only significant state that has an ‘open access’ market that will allow such transactions. In fact, this ‘open access’ situation is what encouraged a host of firms to rush to set up renewable set ups there, helping the state emerge as the no.1 in the renewables pecking order recently.

Panelists included Arun Bhalla, ED-CPP Dalmia Bharat Cement, Bruce Douglas, the Deputy CEO SolarPower Europe and the European Alliance for Corporate RE sourcing, Gopal Saxena, from BSES Delhi, representing the Discom view, Charles Donovan from the Centre for Climate Finance of Imperial College, London, Chetan Nanda, CEO, Softbank, Venkatesh Sharma, representing Toyota Kirloskar, and Sanjib Bezbaroa, EVP Environment, Health and safety at ITC Limited.

The discussion got off to a strong pitch for a vibrant corporate buyers market, made by Bruce, who showcased the efforts made in Europe, that needed a better policy environment to go much further. Dr Charles Donovan likened the coming change in the energy purchase market to a tsunami, warning stakeholders to strap up for a wild ride as markets are roiled by these new changes, or risk being shut out. He emphasised on the need for a market like India, where discoms have a massive job to do serving the unmet as well as the poorly served segments of the population, not to go the European way where the corporate buyers market has caused the famous ‘discom death spiral’, with the best and biggest customers of discoms moving away to direct purchases.

Dr Charles warning brought out Gopal Saxena of BSES Delhi at his counter punching best. Pointing out that not a single MW of the 806 MW of renewable purchase obligations for BSES Delhi had been met though merchant renewable power, he expressed serious doubts about any early ‘irrational exuberance’ about renewables replacing fossil plants anytime soon. Pointing out to almost 70,000 MW of stranded coal based thermal capacity and a further 20,000 MW of gas based capacity, he urged a level playing field to ensure these assets didnot turn sick, even before renewables have provided a long term solution. Stressing on the critical requirement of scale, aggregation of demand and payment security to make renewable investments worthwhile, Saxena stood out for being the strongest voice of dissent.

Both the corporate participants, had their own share of experiences and challenges to share. Sanjib Bezbaroa of ITC Limited spoke about how almost 43% o ITC’s energy consumption is already from renewable sources. Advising corporates to start first by reducing their overall energy footprint, he stressed on the need to look beyond just electricity as a component of renewable consumption. ‘In the last 15 years, even as our total manufacturing units have doubled, our gross energy demand has come down’, he pointed out, giving the firm a much greener footprint than just their power consumption figures would indicate.

Toyota Kirloskar’s representative, Vishwanath Sharma shared how the firm started off from a small internal project, last month almost 97% of their electricity consumption of 86 million units was recouped through renewable production. He cautioned the audience about keeping track of something as basic as the ability of rooftops to bear the load of a solar setup, pointing out that sometimes something as simple as this can become a roadblock, and change the project costings completely. Solar costs in India, according to him, are way more competitive than South East Asia, making the case for renewables even stronger.

At IamRenew, we believe that the corporate case for renewables has to consider both the ITC perspective of considering the larger energy footprint, and finally, even when it comes to power consumption, a much more aggressive plan to shift. Keep in mind that worldwide, over 2/3rds of electricity consumption is by industry. In India, the figure is easily over 40%, with the rest divided between agriculture and households and some commercial. So if an entity like the government sets off with a target of 40% renewables by 2030, corporates need to do much, much better. Global bodies like the RE100 etc simply provide cover for a transition at their own terms, by lobbying for a supportive environment. A really responsible corporate would, and should do much more. This pledging business would probably not be needed if consumers were more aware, and started demanding more aggressive behaviour from the firms selling goods, on pain of shifting to someone who does more. In the new world of responsible millenials, we firmly believe that is the way to go. In specific terms, that means, every corporate, industrial clusters and other pockets where demand can be aggregated, need to push for far higher renewable targets than being done now. That will not just create a better market for renewables, it could also help create policies that don’t disincentivise discoms in India from supporting the shift to renewables.