Carbon Trading Kicks Off In Indonesia

September 26 marked a big day for Indonesia, as carbon trading became a reality for the first time in the country. The Indonesia Stock Exchange (IDX) launched a carbon trading platform, with a view to mobilize market driven incentives for the country.

The country’s coal plant operators have to mandatorily buy carbon credits to offset their emissions impact now. That will open up a market for firms that can actually generate or earn carbon credits through energy efficiency or other mitigation efforts. As a coal rich country, Indonesia has found it tough to consider other renewable energy options, exacerbated by its geography, which is not too friendly for potential nuclear power too. Efforts are being made however, with alternative energy sources with an potential for 3,686 GW from solar, micro-hydro, bioenergy, wind turbine, geothermal and sea currents identified. But as of last year, total utilized capacity had reached just 12.56 GW.

The national electricity company, Perusahaan Listrik Negara (PLN) is the biggest ‘offender’, thanks to its high use of coal across its 130 coal power plants producing over 20 gigawatts as of 2022. It has announced a plan for the early retirement of coal power plants and to end all new construction by 2030.

The first trade on the exchange was executed by a geothermal project of state-owned energy giant Pertamina in North Sulawesi province. It had registered around 800,000 tonnes of carbon dioxide equivalent with traded volume of 459,914 CO2 equivalent priced at 69,600 rupiah per tonne. The transaction recorded 13 total trades and orders from 16 registered users.

All participants are required to register with the Ministry of Environment and Forestry to engage in carbon trading at the IDX.

President Joko Widodo has set a target of 3 quadrillion rupiah ($194 billion) by 2030 for the exchange.

Besides almost 100 coal power plants in the country, projects from its forestry, agriculture, waste, oil and gas, processing and marine industries are also eligible and expected to participate in the trading on the exchange. It is widely expected that as the hopes of limiting temperature rise to below 1,5 degree recedes, more and more industries will be brought within the ambit of a carbon emissions regime, even at the risk of raising cost of operations.

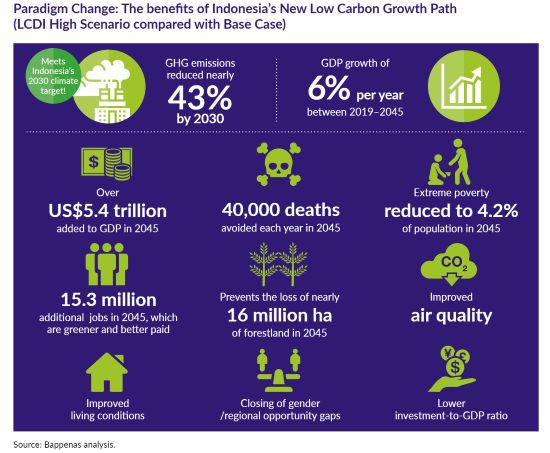

Indonesia, which ratified the Paris Agreement in 2016, set its nationally determined contribution (NDC) for greenhouse gas emission reduction at 43.2% by 2030 and has established a goal of reaching net-zero carbon emissions by 2060.

Those initiatives include implementing the carbon trading scheme.