Gulshan Polyols secured Rs 993 crore ethanol supply order

Gulshan Polyols gets the awarded through a tender issued by OMCs under the Ethanol Blended Petrol Program (EBPP) for the Ethanol Supply Year (ESY) 2024-25, with distribution across various locations nationwide.

India’s one of the leading ethanol maker Gulshan Polyols Limited has secured a contract valued at about ₹993 crore for the supply of 142,222 kiloliters of ethanol to major oil marketing companies (OMCs). These contracted OMCs are Bharat Petroleum Corporation Limited (BPCL), Indian Oil Corporation Limited (IOCL), and Hindustan Petroleum Corporation Limited (HPCL).

As per the details revealed by Gulshan Polyols, this contract was awarded through a tender issued by OMCs under the Ethanol Blended Petrol Program (EBPP) for the Ethanol Supply Year (ESY) 2024-25, with distribution across various locations nationwide.

For ESY 2024-25 – Cycle 1, the major oil marketing companies allocated approximately 837 crore liters of ethanol from the 970 crore liters of offers submitted by manufacturers across India. The initial tender invited bids for 916 crore liters of ethanol supply for ESY 2024-25.

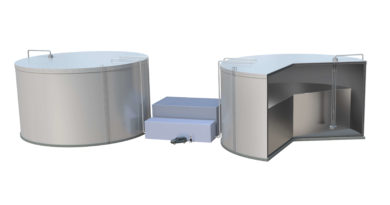

Gulshan Polyols is a leading Indian producer of ethanol/bio-fuels and specialty products based on grain and minerals. The company’s business portfolio covers three main segments which includes grain processing, bio-fuel/distillery, and mineral processing operations.

Recently, Gulshan Polyols secured a contract worth Rs 18.85 crore to supply 2,713 kiloliters of ethanol the same very OMCs. The company also commenced commercial operations of ethanol at its 250 KLPD capacity ethanol plant at its grain-based facility in Goalpara, Assam.

Originally established as Gulshan Sugars & Chemicals Limited in 1981, Gulshan Polyols Limited (GPL) began by manufacturing Precipitated Calcium Carbonate (PCC) and Activated Calcium Carbonate (ACC) with an initial capacity of 2,100 MTPA in Muzaffarnagar, UP. Over the years, GPL has significantly expanded its production capabilities to 105,000 MTPA.

In terms of financial performance, the company reported a profit after tax (PAT) of Rs 6.4 crore in Q4 FY24, compared to Rs 14.6 crore in Q4 FY23, reflecting a decline of 56.2% due to high raw material prices driven by increased demand for raw materials and grain across the country.