As The World’s Largest Carbon Capture Project Struggles, Questions on Efficacy of CCS Projections

Gorgon Project underdelivers

Gorgon Project underdelivers

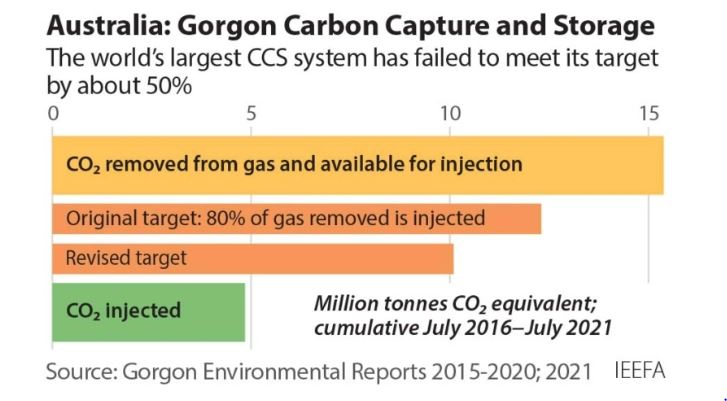

Despite a cost of more than A$3 billion, Gorgon, the largest carbon capture and storage (CCS) project in the world, has failed to deliver, underperforming its targets by about 50% for the first five years of operation. This was the finding of a report by IEEFA (Institute for Energy Economics and Financial Analysis), which analysed the numbers.

Carbon capture technology has long been used to enhance oil recovery (EOR) – selling captured CO2 to oil companies to push more oil out of depleted wells, making any initial “carbon capture” negligible. About 73% of carbon capture globally is currently used for EOR projects – called Carbon Capture Utilisation and Storage (CCUS).

Although Gorgon’s gas plant produced its first LNG cargo in March 2016, the first CO2 injection from its CCS facility occurred in August 2019. The Gorgon CCS project was initially planned to capture and inject underground up to 4 million tonnes (MT) of reservoir CO2 each year from the extraction and production of reservoir gas. Instead, the project sequestered on average less than 1MT per year.

CCS technology has been operating for 50 years. If Chevron and its partners can’t get it to work these past 5 years at Gorgon, it’s not an effective technology for reducing carbon emissions. Gorgon recently agreed to buy and surrender credible greenhouse gas offsets recognised by the West Australian Government to offset its target shortfall of 5.23 million tonnes of CO2.

The sudden reduction in price created an opportunity for big polluters like Chevron to offset its emissions shortfall by paying around US$100 million less, if it planned to source all the required offsets from the Australian market.

Gorgon’s frequent inefficiencies, and problems that led to underperformance in capturing carbon and injecting it, are typical of the technical risks involved in CCS projects. Apart from the credibility of carbon credits in offsetting emissions being under question, Gorgon’s underperformance in meeting its emission targets has brought about a material cost for Chevron and its major partners Exxon Mobil and Shell.

Despite mounting evidence, the governments around the world are considering the subsidized investments for CCS and CCUS projects as emission reduction solutions. That has to be questioned as way of kicking the problem down the road, without any clarity on finding a solution in CCS in the future. Alternatively, it is also a signal to invest further, and more heavily in building the CCS technologies that are actually viable. Earlier.

When an energy technology is consistently shown not to work, but can attract subsidies, you can be sure there are lobbyists and greenwashing at play. The oil and gas industry are harvesting subsidies to prolong the life of their operations, not for emissions reduction.

The emissions unaccounted for – the Scope 3 emissions – are where the big problem lies.

Unfortunately, it is also no surprise that the biggest votaries of CCS technologies have been oil and gas giants that are unwilling or unable to invest earlier in their polluting impact on the planet. By promising to do so on the back of technologies that are as yet unable to deliver clearly, it is clear that these firms are happy to stake the planet’s future on their present profits.