With Early Winter, India’s Power Sector Braces For Demand Chill Impact

As winter sets in a little earlier this year, with record low temperatures in North India, India’s power sector will also shiver a little, as this will have repurcussions for the sector too. For a sector that has barely seen a full recovery to pre-covid levels of demand in September, and some much needed growth in October this year (13.38 percent at 110.94 BU) , a continued revival of demand has become vital, not just for the renewable energy sector that is thrusting to add capacity, but also the broader power sector.

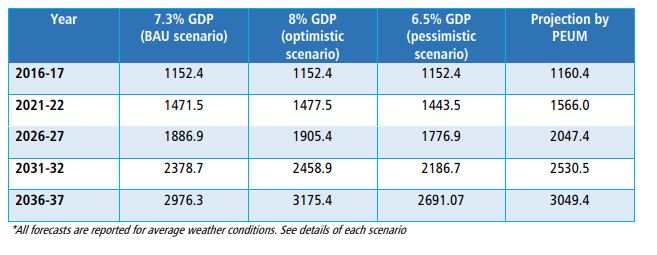

The Central Electricity Authority, in its report on long term electricity demand forecasting, brought out in August 2019, had made detailed forecasts for demand right to 2036. The modeling is already under severe strain, barely a year down the line, thanks to two issues, at least one of them self inflicted. While the covid impact is understandable, the CEA, under its three growth scenarios to estimate demand, has considered rates of 6.5 percent (pessimistic), 7.3 percent, and 8 percent. Even in 2019, these assumptions were already a stretch, considering the country was well into a slowdown, and ended 2019 with a growth rate of just 4.2 percent. With 2020 expected to end with a negative growth rate of anything around -10 percent ( a sharp recovery being seen since October might just improve that figure a couple of notches), the CEA might be feeling the need to relook its full projections again.

Under its business as usual (BAU) scenario of 7.3 percent, the CEA had projected an increase in electrical energy requirement at a CAGR of 4.86 percent for the period FY 2016-17 to FY 2036-37. Energy Requirement was projected to increase from 1152.4 BU in 2016-17 to 1886.9 BU in 2026-27, 2378.7 BU in 2031-32 and 2976.3 BU in 2036-37. Under the baseline scenario, the electrical energy requirement was projected to increase 2.58 times between FY 2016-17 and FY 2036-37. These figures were based on its Partial Adjustment Model (PAM). Even on its alternate model, the Seemingly Unrelated Regression (SUR) model, growth projections have been even higher.

In 2020, interestingly, beyond Covid, electricity demand has held up relatively well considering the well documented impact of more rainfall days, that an extended monsoon brought this year to many parts. Now, the sector has to contend with the impact of CDD , or Cooling Degree Days, when the downward impact on demand is much higher in Northern, ‘hot’ states.

Consider how even under its ‘pessimistic’ scenario for 2021-22, peak power demand was estimated at 1443 BU (billion units). Generation in 2019-20 was 1389 BU , according to the power ministry, which means after capacity additions, the power surplus of 2020-21 will only get much worse in 2021-22. Till September this year, curtailed generation, at 676 billion units has been more than adequate to meet the subdued demand.

With the onset of winter, going by previous years, and a return to BAU as October numbers indicate, we can hope to see this figure touch around 1260 BU (very optimistic) by the year end in March 2021. That will call for a demand increase of a minimum of 15 percent between this year and the next, to keep up with CEA projections. When the average demand growth in the past decade has been barely 5.5 percent per annum. And any GDP growth figure should ideally be seen against 2019-20 numbers, since 2020-21 will simply distort it with the low base effect.

That calls or a serious look at the long term demand forecasting model, as it might be well off its projections through all of 2024-25 and even beyond as growth recovers slowly. For renewable energy producers, which have benefited from must run status in the past year, the lack of demand will continue to throw up challenges in terms of discom demand. Fresh capacity will struggle, unless steps are taken now to create demand for it.