EVs Grab a Bigger Chunk in Shrinking Passenger Cars Market: IEA

The global electric vehicle (EV) fleet expanded significantly over the last decade, underpinned by supportive policies and technology advances. And while in 2019, the global sales of passenger vehicles tanked, electric vehicles (EVs) had another banner year.

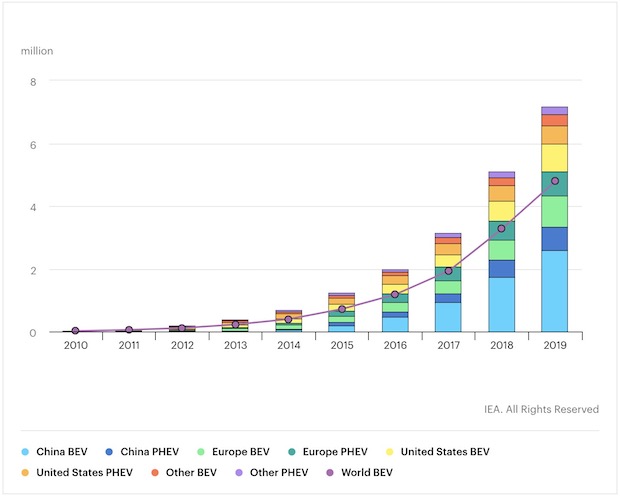

In its recently published report “Global EV Outlook 2020”, the International Energy Agency (IEA) details that the sales of EVs topped 2.1 million globally in 2019, surpassing 2018 – already a record year – to boost the stock to 7.2 million electric cars. EVs, which accounted for 2.6 percent of global car sales and about 1 percent of global car stock in 2019, registered a 40 percent year-on-year increase.

The report highlighted that as technological progress in the electrification of two/three-wheelers, buses, and trucks advances and the market for them grows, electric vehicles are expanding significantly. Ambitious policy announcements have been critical in stimulating the electric-vehicle rollout in major vehicle markets in recent years. In 2019, indications of a continuing shift from direct subsidies to policy approaches that rely more on regulatory and other structural measures – including zero-emission vehicles mandates and fuel economy standards – have set clear, long-term signals to the auto industry and consumers that support the transition in an economically sustainable manner for governments.

Further adding that after entering commercial markets in the first half of the decade, electric car sales have soared. Only about 17,000 electric cars were on the world’s roads in 2010. By 2019, that number had swelled to 7.2 million, 47 percent of which were in The People’s Republic of China. Nine countries had more than 100,000 electric vehicles on the road. At least 20 countries reached market shares above 1 percent.

The 2.1 million electric car sales in 2019 represent a 6 percent growth from the previous year, down from year-on-year sales growth at least above 30 percent since 2016. And the report provides three underlying reasons to explain this trend:

- Car markets contracted. Total passenger car sales volumes were depressed in 2019 in many key countries. In the 2010s, fast-growing markets such as China and India for all types of vehicles had lower sales in 2019 than in 2018. Against this backdrop of sluggish sales in 2019, the 2.6 percent market share of electric cars in worldwide car sales constitutes a record. In particular, China (at 4.9 percent) and Europe (at 3.5 percent) achieved new records in the electric vehicle market share in 2019.

- Purchase subsidies were reduced in key markets. China cut electric car purchase subsidies by about half in 2019 (as part of a gradual phase-out of direct incentives set out in 2016). The US federal tax credit programme ran out for key electric vehicle automakers such as General Motors and Tesla (the tax credit is applicable up to a 200,000 sales cap per automaker). These actions contributed to a significant drop in electric car sales in China in the second half of 2019 and a 10 percent drop in the United States over the year. With 90 percent of global electric car sales concentrated in China, Europe and the United States, this affected global sales and overshadowed the notable 50 percent sales increase in Europe in 2019, thus slowing the growth trend.

- Consumer expectations of further technology improvements and new models. Today’s consumer profile in the electric car market is evolving from early adopters and technophile purchasers to mass adoption. Significant improvements in technology and a wider variety of electric car models on offer have stimulated consumer purchase decisions. The 2018-19 versions of some common electric car models display a battery energy density that is 20-100 percent higher than were their counterparts in 2012. Further, battery costs have decreased by more than 85 percent since 2010. The delivery of new mass-market models such as the Tesla Model 3 caused a spike in sales in 2018 in key markets such as the United States. Automakers have announced a diversified menu of electric cars, many of which are expected in 2020 or 2021. For the next five years, automakers have announced plans to release another 200 new electric car models, many of which are in the popular sport utility vehicle market segment. As improvements in technical performance and cost reductions continue, consumers are placed in the position of being attracted to a product but wondering if it would be wise to wait for the “latest and greatest model”.

The report also presented its views on how the COVID-19 pandemic will affect the global electric vehicle markets. It added that based on the car sales data from January to April 2020, its current estimate is that the passenger car market will contract by 15 percent over the year relative to 2019, while electric vehicle sales for passenger and commercial light-duty vehicles will remain broadly at 2019 levels. While also stating that a second wave of the pandemic and slower-than-expected economic recovery could lead to different outcomes, as well as to strategies for automakers to cope with regulatory standards.

“Overall, we estimate that electric vehicle sales will account for about 3 percent of global car sales in 2020.,” the report stated.

Source: saurenergy.com