WoodMac Predicts Big EV Hit from Coronavirus in 2020

The Wait Could be longer

The Wait Could be longer

Tesla, and multiple other EV start ups are going to be severely tested in 2020.

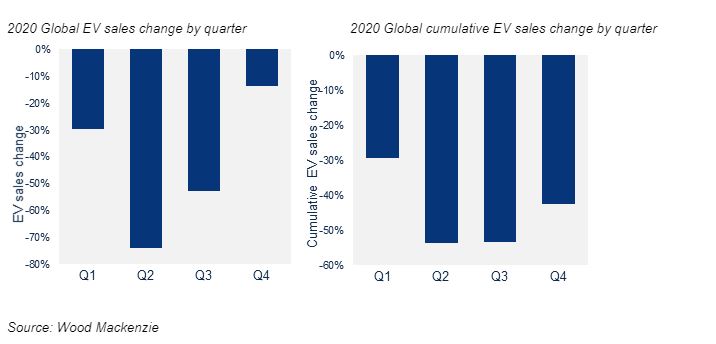

Research firm Wood Mackenzie has released a report where it predicts a 43 percent contraction in the global EV industry by the end of 2020. Key markets, especially the US and Europe will bear the brunt of the drop, taking longest to recover, even as it predicts the Chinese market to be back at 2019 levels by November 2019. The China market was, like many other markets, becoming the main egine of growth for EV’s too, till the virus stuck. One of the biggest assumptions behind even these projections is the hope for a government powered stimulus for the sector in most markets.

Global electric vehicle (EV) sales closed at 2.2 million in 2019. This number is expected to drop by 43% to 1.3 million by the end of 2020.

The coronavirus outbreak, coupled with potential deferral of fleet expansions by large fleet owners due to lower oil price and a wait-and-see approach to buying new models have all contributed to this decrease in projected sales. For example, major operators like Uber, Ola have already seen a massive crash in daily rides on their platforms, putting their plans to shift their driver partners to EV’s at serious risk.

Wood Mackenzie’s analysis notes that China will catch up to 2019 demand by November 2020, while Europe will do so by December. Year-over-year demand in the US is projected to lag 2019 demand by 30% by the close of 2020.

“At the end of January, sales of all cars in China were down by 21% compared to 2019. By February, they had plunged by 80%. EV sales were hit harder, with January numbers down 54% and February projected to be down more than 90%. EVs have constituted approximately 5% of all vehicles sales in China for the past two years.

“Most new EV buyers are still first-time owners of the technology. The uncertainty and fear created by the outbreak has made consumers less inclined to adopt a new technology. Once the epidemic is contained in China, we suspect consumers will flock back to car dealers and reaffirm their confidence in EVs.

“In stark contrast, EV sales in Europe saw a 121% increase in January – despite a 7% reduction in the overall market. The trend of increasing EV adoption persisted into February, albeit lower than the previous month.

“However, the first case of coronavirus was not reported in the region until late January. The infection rate is expected to peak in Europe and North America towards the end of H1 2020, approximately two months after China. The January and February numbers therefore do not yet reflect the impact of coronavirus in the two regions.

“The first lockdown in the US did not start until 20th March but the effects have already begun to show in EV sales. General Motors is offering a discount of US$10,000 for its Chevrolet Bolt. Further such rebates are sure to follow to move inventory as demand drops further,” said Ram Chandrasekaran, Wood Mackenzie Principal Analyst.

In an unorthodox move, traditional automakers entering the EV market have announced upcoming models that will be launched over the next several years rather than over the next 12 months.

“Ford introduced its Mustang Mach E in November 2019 but it won’t be widely available until H1 2021. Volkswagen has been promoting the ID.3 for several years but isn’t expected to starting selling the model until later this year. General Motors celebrated an ‘EV Day’ on 4th March to tout its readiness for the transition to electric vehicles, however none of its new products are going to be available until late 2021.

“The automakers’ response to the pandemic – suspending car manufacturing to focus on making medical equipment – is only going to delay model launches further.

“From a consumer’s perspective, however, it makes perfect sense to wait longer for these models. After all, a car purchase is a large financial investment that lasts several years. Unfortunately, for EV adoption, this is likely to lead to a plateauing of sales in the near term. While the pent-up demand from the pandemic will help a bounce back in sales later in the year, new demand growth will lack until 2021.

“Despite the potential delays in EV adoption, several automakers have expressed a desire to be carbon neutral due to government policies and a change in investor attitude. The shift towards sustainability is the driving force behind the electrification of transport. Uncertainty caused by the oil price war and global catastrophes will only serve to strengthen that resolve, not deter it,” added Chandrasekaran.

For India, although the report does not delve deeply into the impact at all due to the incipient stage of the market, its fair to say that the impact will be profound, especially in the 4 wheeler segment. The two wheeler segment is expected to recover much faster due to smaller ticket sizes, as well as much more evolved distribution and charging network being put into place by sellers.

A big hit could be taken by the wildly popular E-rickshaw segment, which were only now beginning to shift from outdated lead-acid battery powered models to more modern Lithium Ion and others battery technologies. Due to their use by, and ownership by a sement particularly sensitive to costs, and with limited access to credit, the hit here might be much more bigger than expected.

On the remaining private four wheeler now, expect deferral by upto 6 months or more, when it comes to launch plans for EV’s.

The only segment that still offers hope is the larger public transportation segment , where government backed subsidies and orders already placed or in the pipeline should ensure steady addition to the EV fleets countrywide.