Indian EV Sales Cross 7.5 Lakh in 2018; Brings Guarded Optimism

The road to Greener Transportation

The road to Greener Transportation

Thanks to the country’s budding electric vehicle (EV) industry, which has taken a leap by selling over 7.5 lakh units in Financial Year (FY) 2018-19, as it has registered a growth of record 31.8 per cent (as compared to the previous financial year) for the first time.

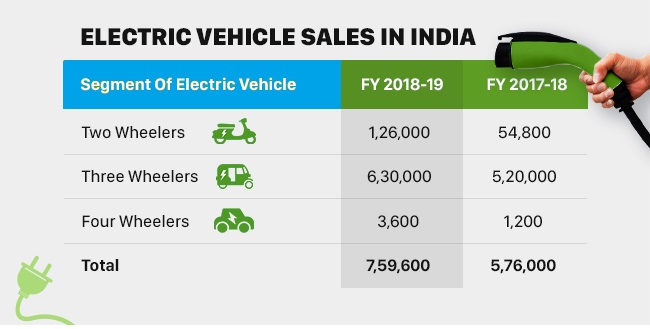

According to the data shared by the Society of Manufacturers of Electric Vehicles (SMEV), an association of Indian manufacturers of EVs and their components, the e-mobility industry has notched handsome numbers in all three segments – two-wheelers, three-wheelers, and four-wheelers.

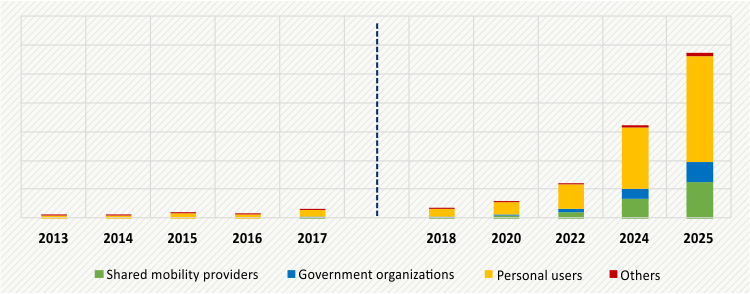

The growth in the sale of EVs is in line with the government of India’s push towards electric mobility in a bid to control the rising vehicular pollution and its vision of having at least 30 percent of vehicles on road as electric by 2030.

The association which collated the data from every EV manufacturer of the country said that the total EV sale in FY 2018-19 was 7,59,600 units which include 1,26,000 electric two-wheelers, 6,30,000 electric three-wheelers, and 3,600 electric four-wheelers. These sales digits translate into electric two-wheelers witnessing a growth of 130 percent and four-wheelers witnessing a growth of 200 percent while there is a growth of 21 percent in electric three-wheelers.

Commenting on the numbers, a spokesperson of SMEV said, “The EV industry has seen a decent leap in the last financial year. The FY 2018-19 has been an important year for Indian EVs. Many new start-ups joined the industry in the two-wheelers segment like PureEV, Avan, Garvit, and others and a number of domestic and international car manufacturers like Audi, Hyundai, Kia, and MG Motors announced the launch of their electric cars in the country along with new ventures coming up in the shared mobility sector like Blue Smart and Glyd. Apart from this, a slew of electric vehicles charging stations were installed in many states like Andhra Pradesh, Delhi and Telengana during the year. The charging infrastructure got a boost from Ministry of Power when it announced that no license would be required to install EV charging stations, in December last year. The government also promoted electric mobility by asking ministries and other government agencies to include EVs in their fleet of transport.”

The Financial Year 2018-19 also saw the launch of the much-awaited second phase of the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) India scheme or FAME II which aims to promote electric mobility by incentivizing electric vehicles. FAME II focuses on increasing the number of EVs on road by encouraging the electrification of vehicles in the commercial and public domain.

Difficult road ahead

According to Sohinder Gill, Director General of SMEV, in a country that has an automobile market of over 2.5 crore vehicles, EV industry is only 3 percent of it, which is miniscule. Further to this, SMEV’s analysis reveals that post implementation of the FAME II scheme there has been a drastic brought down in the sales of electric vehicles for the month of April of current financial year due to lack of incentives for private EVs.

The Indian electric car market is projected to reach $707.4 million by 2025, according to P&S Intelligence, witnessing a CAGR of 34.5% during the forecast period. But the growth is mainly driven by government schemes, growing environmental concerns, and falling battery prices. There is a growth prospect in the transport sector for Indian carmakers. India is currently following Bharat Stage IV (BS IV) norms and would be moving to BS VI emission standard by 2020, skipping BS V. The government has decided to go directly from BS IV to BS VI fuel standards due to environmental degradation, growing pollution levels, and health hazards caused by vehicular pollution.

Though the result for FY 2018-19 shows an exciting growth compared to the previous year, the industry continues to be concerned about the future of electric vehicles post implementation of the new FAME II from April 1, 2019. If the trend as observed in April continues, it will be very difficult to achieve even 50 percent of the expected target by 2030. There is a need of corrective measures and supportive policies under the second phase of FAME to pick up the pace which the industry lost at the beginning of the current financial year, in order to cross the benchmark created by it in the last financial year.